LuxUrban Hotels: Another Way To Be An OTA?

99% sure this is in the too hard pile, but it's one of the most interesting things I've come across this year

I recently came across an interesting situation. It doesn’t quite fit the mandate so I don’t think I’ll be able to spend more than a couple of hours on it, but I wanted to write something down to see if there was anyone else who has looked it or finds it interesting. Feel free to reach out about it.

From the company’s website: “LuxUrban Hotels Inc. utilizes a long-term lease, asset-light business model to acquire and manage a growing portfolio of short-term rental properties in major metropolitan cities. The Company’s future growth focuses primarily on seeking to create “win-win” opportunities for owners of dislocated hotels, including those impacted by COVID-19 travel restrictions, while providing favorable operating margins. LuxUrban Hotels operates these properties in a cost-effective manner by leveraging technology to identify, acquire, manage, and market them globally to business and vacation travelers through dozens of third-party sales and distribution channels, and the Company’s own online portal. Guests at LuxUrban Hotels properties are provided high quality service under the Company’s consumer brand, LuxUrbanTM.”

So, summarily, it sounds like they are leasing out entire hotels (recently pivoted from multifamily) and then selling the rooms.

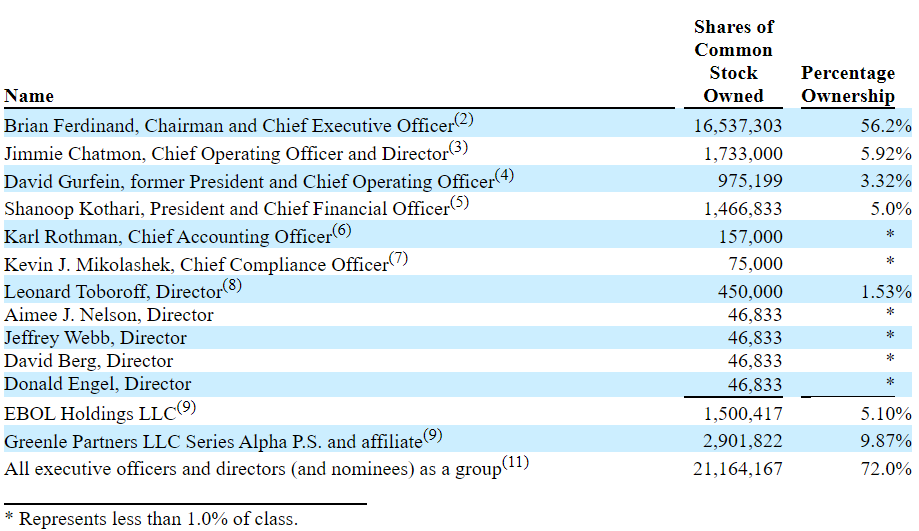

Beneficial ownership as of April 2023 can be seen below:

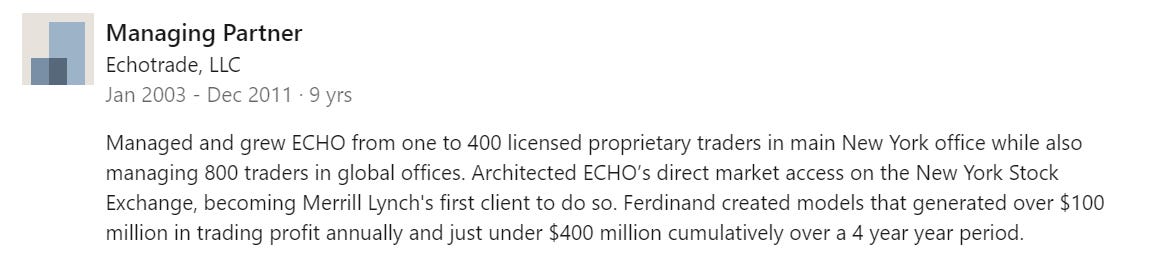

CEO Brian Ferdinand owns over half the company. His LinkedIn profile is interesting. I have not seen many public company CEOs with their name as their profile picture. He was also portfolio manager at Sharp Capital LP, managing a L/S book, from Sept 2001-Dec 2002 despite having finished undergrad at University of Kansas in 1999 and his Masters in Psychology at Fairleigh Dickinson in 2001. The stint at Sharp was followed by this:

He then founded a cloud based software/brokerage company, was COO of a vacation rental company, and founded LUXH’s predecessor company in 2017.

David Gurfein, cofounder and former COO who owns 3%, was featured on Capital Allocators in the early days of the podcast.

The slide deck is also really interesting. Perhaps what stands out more than anything is just how much the company has grown in the last couple of years. They moved quickly to capitalize on an opportunity from COVID. Many hotels refinanced at low rates and high valuations in 2015-2020. Now they need to refinance again now, and they either need to bring money to the table or bring a sublease (which is where LUXH comes in) as a secured form of revenue.

Some items of note from the slide deck:

Avg lease life of 23 years

“Minimum capital requirements…outsized ROE opportunity”

“Partnership with Wyndham Hotels & Resorts (NYSE: WH) expected to accelerate growth beginning in Q4 2023… WH to fund ~ 50% or more of LUXH acquisition costs… WH sales / distribution / technology platform will help drive RevPAR, expand margins, improve customer experience… 17 LuxUrban Hotels to join Trademark Collection by Wyndham by Q4 2023… Term of 15-20 years, with LuxUrban maintaining operational control... Access to 100+ M member Wyndham Rewards Program, which accounts for one out of every two U.S. bookings.”

This is what originally caught my eye about the company. You can read a recent press release here, which also mentions agreements they have recently struck with their second largest shareholder, Greenle Partners, that will provide them with further runway and time to execute. There isn’t much information out there on Greenle Partners, but based on the disclosures in the proxy I believe this is the guy who runs it.

The fact that they are partnering with Wyndham makes this more interesting to me, as I think it is reasonable to assume that a company like Wyndham has done their diligence in determining who they should go into business with.

Expecting net rental revenue of $115-120m in 2023, up ~3x from 2022. Expecting EBITDA of $25-30m, and $48-60m next year. TTM cash net income is $9m.

$150-$160/night RevPAR property level break-even rate

80% occupancy

They claim to have a six month payback period on capital deployed

$13,554 avg. acquisition cost / [($291 RevPar * 365 days * 25% EBITDA margin) / 12 months]

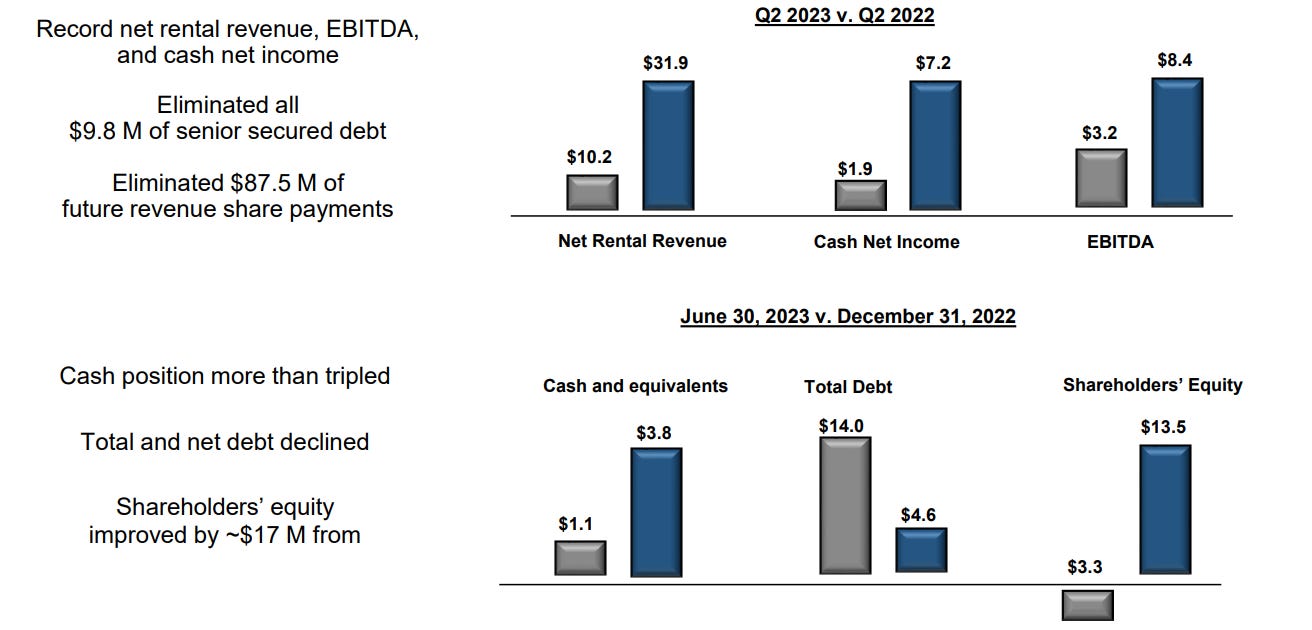

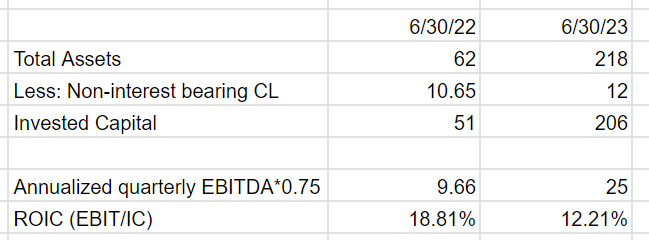

Improved financial metrics pretty much across the board in the past ~12 months:

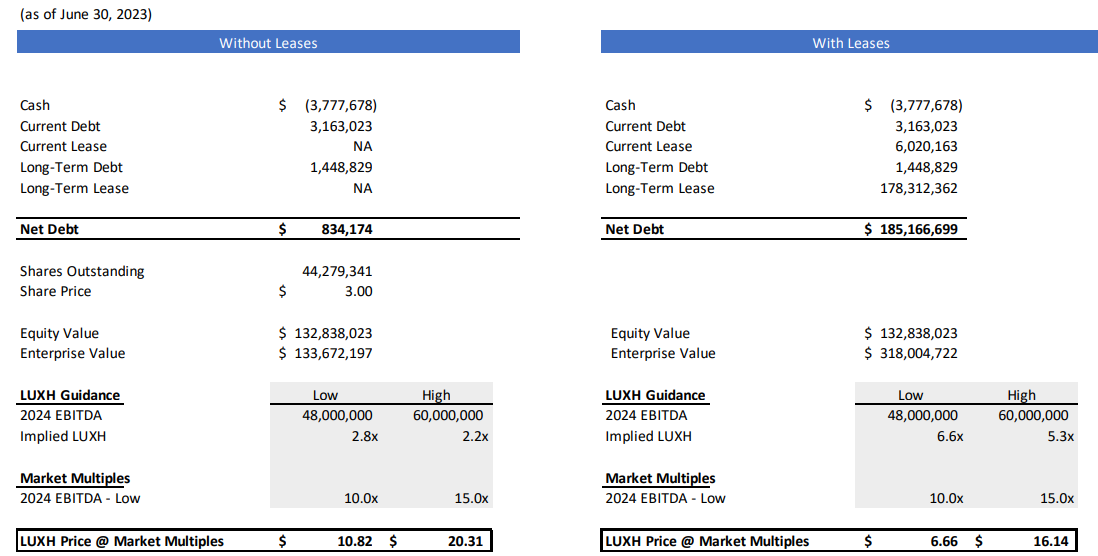

And perhaps the most interesting part of the slide deck, the “potential valuation”. It isn’t often you see something like this where management is suggesting the possibility of such substantial upside in such a short time frame (share price at time of writing is $3.77).

One of the things I don’t have a great grip on is what a true ROIC number should be. Doing some very simple and quick napkin math:

They are guiding to $48-60m EBITDA next year, let’s say they do $40m. As of 6/30/23, invested capital was ~$200m. Based on SoCF in the 6/30 10-Q it looks like like D&A is negligible. Maybe a 25% tax rate? 40*.75= $30m. 30/200 = 15%. There is a huge stock based comp number in the 10-Q but I am assuming this is one-time related to the various transactions they have done recently.

The big question is: how much is invested capital going to grow between now and then? How much is that mitigated by the Wyndham deal? Yes, revenue has grown a lot in the past couple of years, but so has invested capital. If we just look at revenue and total assets- total assets was $108m as of 12/31/22. By 6/30/23, that had grown to $218m. Net rental revenue was $32m in 2Q23 vs $13m in 4Q22. That is 102% growth in assets and 146% growth in revenue, during a time of growing profitability and reduced debt. This is obviously an extremely shorthand calculation, but it’s interesting to look at from a high level. I really don’t know the business well enough to say if a thorough, clean ROIIC calculation could look directionally similar. This back of the envelope calculation points in a different direction. But frankly, this is too short a time period and there are too many moving parts (both top-line and expenses) for any of this to be very meaningful:

Other items of note:

Shares outstanding increased from 26.5m as of the 2Q22 10-Q to 36m (44m including committed to be issued but not yet issued) as of the 2Q23 10-Q. I have not dug into what exactly caused this and whether it is likely to continue. I’m assuming it has to do with deals recently done with Greenle (and possibly other parties) to eliminate various forms of debt and improve the balance sheet.

The company is being sued for $1.5m and currently reserves for almost $1m

13F searches and Twitter searches for mentions of LUXH have turned up basically nothing for me. Makes sense given the market cap is $134m and the CEO owns more than half.

The title of this is somewhat in jest, I know LUXH isn’t an OTA. But it’s an interesting comparison. OTAs don’t have 23 year leases. OTAs don’t have inventory risk. You just can’t get much more capital light than being on OTA. Look at the ROICs they generate. But maybe WH helps LUXH with this over time. And I am guessing that LUXH is being compensated for that inventory risk fairly well, with decent spreads on the lease vs rates (hence what seems like low breakeven RevPAR levels). The point is - this LUXH model seems really unique. I’m just not sure if it’s good or bad. Or maybe it’s just opportunistic and it is good for a time in the sense that they are capitalizing on the refinancing/COVID opportunity. Are they getting really good terms on the leases as a result? Do they stay good over time or eventually revert to normal? Etc. Both OTAs and LUXH offer distribution, but only LUXH offers it in the form of secured revenue.

Disclosure: This is not investment advice. I/we may have positions in securities mentioned.

Nice writeup. It's very interesting given the near term opportunity. If they come close to FY24 guidance and then give an increased guide for FY25 they could be trading at like 2-3x EBITDA. Management thinks FCF conversion will be at least 50%.

They are trying to get to 9-12k units (rooms) by the end of FY24, up from 2,750 at the end of FY23. If they can get half of those rooms operational, and another half operational for half of the year, they will exceed their FY24 guidance for both revenues and EBITDA.

The Wyndham key money also eliminates any need for financing / short term working capital and can be recycled into even more new properties. There is also a bunch of hair as you pointed out, but if they can execute over the next few quarters the stock likely re-rates

Stumbled across this one as well. While having Wyndham there is nice, I’m reminded of Theranos/Walgreens, GM/Nikola etc. LUXH doesn’t fit my mandate either, need to find time to dig in. Stock doing well lately.