THRY: Melting Ice Cubes, SaaS Dreams, and the Long Road to Reinvention

Why Thryv’s Business Model Shift Is Promising on Paper, but Hard to Underwrite in Practice

TLDR

Thryv is a legacy yellow pages company transforming into a SaaS provider for small businesses, converting print customers to software subscribers while acquiring Keap for $80M to move upmarket. While the strategy shows progress with Rule of 40 performance and growing multi-product usage, the business remains fragile. Most SaaS growth comes from internal conversions rather than new customers, churn runs 1.5-2% monthly, and there's no clear moat in a competitive SMB market. I see potential upside scenarios but find the probability distribution too uncertain to warrant conviction, placing it in my "too-hard pile" despite respecting management's execution.

Introduction

Thryv has been written up extensively in the investment world, with detailed coverage from VIC contributors, Laughing Water Capital’s letters, and Inflexio Research. So I’ll keep this overview brief.

At its core, this is a story of phone books and SaaS. An unlikely pairing at first glance.

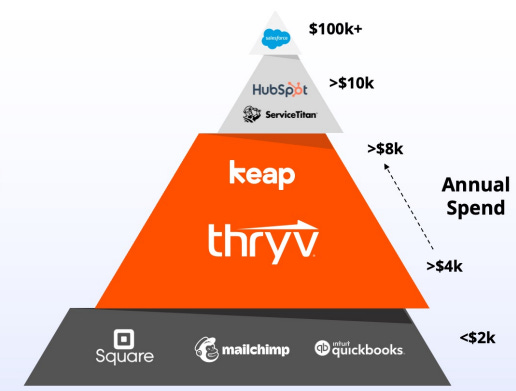

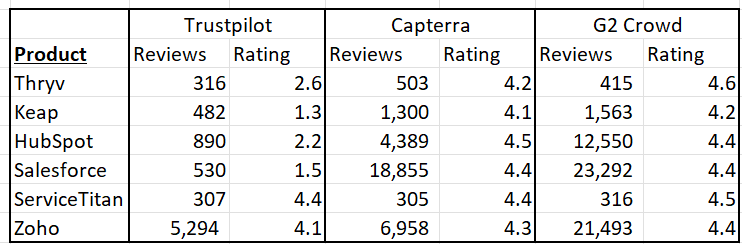

The thread connecting the two is the customer base: small businesses. The same plumbers, roofers, and local service providers who once relied on print directories to find customers are now being offered a suite of software tools by the same company. Thryv’s CRM-like platform, delivered through modular “Centers,” aims to help them run and grow their businesses: Business Center for operations, Marketing Center for lead generation and online presence, and Command Center for communications. It competes down-market from HubSpot, which itself competes down-market from Salesforce. In late 2024, Thryv also acquired Keap, a CRM/marketing automation player, for roughly 1x revenue.

Source: 1Q25 Investor Presentation

Recently, the company has been executing on a strategy of converting legacy phone book customers (this segment is referred to as Marketing Services) into SaaS customers.

This is a major transformation effort that raises important questions around product quality, sales motion, leadership execution, and the long-term economics of selling into small businesses.

My goal here is to present the key facts and framing in a clear and useful format. I am not trying to make a call on whether the stock is a buy or sell. I just want to provide enough context so that readers can decide for themselves whether it is worth more of their time.

As for me, I find the situation interesting and lean slightly positive. But not enough to build a high-conviction position. For now, it belongs in the too-hard pile.

Where They Came From

Thryv’s roots go back to the yellow pages era. The company as it exists today is the product of several mergers, acquisitions, and restructurings tied to the decline of print advertising.

The path starts with two legacy directory businesses: Dex One and SuperMedia. Both had already gone through their own bankruptcies by the early 2010s. In 2013, they merged. Then in 2016, the combined company went through a pre-packaged bankruptcy to clean up its balance sheet, backed by distressed investors like Paulson, Mudrick, and GoldTree. A year later, the business acquired YP Holdings from Cerberus for $600 million in cash and a small equity stake.

The new entity consolidated the remaining yellow pages assets under one roof. It continued to publish print and online directories and offered add-on services like basic SEO, SEM, and website setup aimed at small business visibility. This segment still exists today and is now called Marketing Services.

In 2020, the company went public via a direct listing on the NASDAQ. By then, it had already begun investing in software. CEO Joe Walsh joined in 2014 after a long run at Yellowbook, where he led the company through 77 acquisitions, growing it into a $2 billion business. He ultimately took it public. He also served a five-year stint as Executive Chairman of Cambium Learning Group, a public ed-tech firm he helped pivot from print to digital. The stock rose from under $1 to $14.50 before its 2018 acquisition by Veritas.

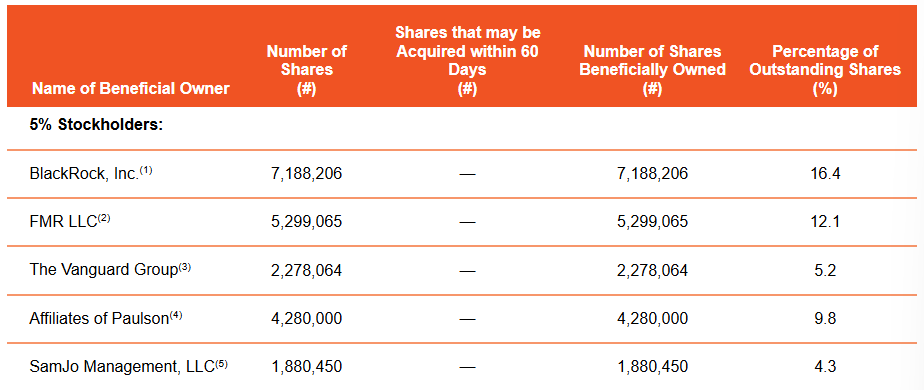

Walsh brought a cohort of longtime colleagues with him to Thryv, forming a close-knit executive team that has overseen the company’s shift from directories to SaaS. He currently owns ~$29m of stock (plus another ~$12m or so of options exercisable within 60 days). Since August of 2023, he has purchased $585k worth of shares at an average price of ~$18.60, most recently buying $67k worth earlier this month. Other notable holders can be seen below:

Thryv’s software effort gained traction over time, leveraging its large base of existing small business customers and a sizable legacy salesforce. In 2021, it acquired Sensis, an Australian yellow pages and marketing company, for $215 million, and began selling SaaS in that market as well.

Today, the company reports in two segments: Marketing Services (the legacy print and digital business) and SaaS (its platform of software products sold under the Thryv and Keap brands).

The Keap Acquisition

In October 2024, Thryv announced the acquisition of Keap (formerly Infusionsoft) for $80 million in cash (~1x revenue). The deal closed on October 31, 2024, marking a pivotal moment in Thryv's transformation strategy.

Keap brings several strategic assets to Thryv. The company specializes in customer relationship management and marketing automation for small businesses, with a particularly strong focus on automation capabilities. These automations go beyond simple marketing tasks - they help businesses streamline operations across sales, service, recruiting, and onboarding processes. As Joe Walsh described it on the 3Q24 call, Keap's automations are "simple yet powerful, and they work really well."

The acquisition addresses a key goal for Thryv: moving upmarket within the small business segment. While Thryv has traditionally served very small businesses with ~2-7 employees, Keap's tools appeal to slightly larger operations with ~15-20 employees - businesses that need more sophisticated automation but aren't ready for enterprise solutions like Salesforce.

Perhaps most importantly, Keap brings an established partner channel of ~700-1,000 certified partners who have been selling Keap's products for years, some for over a decade. This represents a new distribution avenue for Thryv, which has historically relied on its direct salesforce. The partner channel is Keap’s primary distribution method and provides immediate access to international markets, with 20% of Keap's business coming from outside the United States.

From a financial perspective, Keap was generating approximately $85 million in annual revenue at the time of acquisition. While the business had been experiencing some decline - one partner mentioned monthly churn reaching as high as 6% at one point in 2024 (I take this number with a grain of salt but, directionally, that was the sentiment of 2024) - Thryv's management sees significant synergy opportunities. They've projected $50 million in revenue synergies over the first three years ($5 million in year one, $20 million in year two, and $25 million in year three), plus $10 million in cost synergies.

The acquisition also brings 100 additional product and engineering personnel, increasing Thryv's development capacity by 50%. This "acqui-hire" aspect was particularly attractive given Thryv's respect for Keap's technical capabilities and product quality. Additionally, Keap brought $25 million in net operating loss carryforwards, of which $5 million will be used in 2025.

Keap's recent struggles stemmed from both boardroom dysfunction and product execution issues. As Walsh explained, “They had raised a ton of money at higher valuations in the past... about $175-180 million of equity investment over time. And all of these guys were at the very, very, very end of their life, and they were running the business on harvest, trying to figure out how to get their cash out of it.” Strategic missteps, including an unsuccessful attempt to move down-market, compounded these problems. Product reliability suffered, new features were slow and buggy, and the partner base grew frustrated. Despite these challenges, the core CRM and automation functionality remained valuable enough to retain a loyal cohort of users, and both co-founders - Clate Mask and Scott Martineau - are staying on in advisory roles to help with the transition.

The timing of the acquisition required Thryv to issue equity rather than use debt financing, which Walsh acknowledged meant effectively paying $160 million given he thought the stock was trading at half of its intrinsic value.

But management viewed the strategic benefits as worth the dilution: Thryv is good at finding the lead. Keap is good at nurturing it.

What I Learned at Partnerkon

I attended Keap’s Partnerkon 2025 conference in early April, which provided valuable insights into how the integration is progressing. For many partners, this was their first real exposure to Thryv, and the tone was one of cautious optimism.

The partner network had been through a difficult period. During Keap's failed down-market push, product reliability issues emerged and sales teams overpromised on capabilities. Many customers and agencies defected to competitors like HighLevel.

But the conference atmosphere was surprisingly constructive. Thryv demonstrated they were listening - they held Partner Advisory Group sessions early in the week and later presented several well-received product updates. The improvements to Contact Records drew applause, as did the announcement that engineering headcount had increased by 8% rather than being cut. These signals, along with the reintroduction of Alpha/Beta testing programs, helped build confidence.

Thryv also began rolling out Marketing Center to Keap partners, supported by generous sales incentives (3x commission through June for conference attendees). While the integration remains messy - one Keap sales leader acknowledged "two systems right now" with "some wobble" - partners seemed understanding and willing to work through the challenges.

The technical integration is still early. A prototype for cross-platform syncing was demonstrated, but full unification remains a work in progress. The roadmap presented was: November 2024 (two separate products), January 2025 (cross-offering begins), and eventual brand and product merger at an unspecified future date.

Most encouraging was the genuine community feel among partners. These weren't just customers but people who had built their businesses on Keap's platform over many years, and the atmosphere felt more like a reunion of friends than a corporate conference. While it's unclear how representative this core group is of the broader channel, their willingness to give Thryv a chance bodes well for the integration's success. I came away incrementally positive on the deal.

The Situation Today

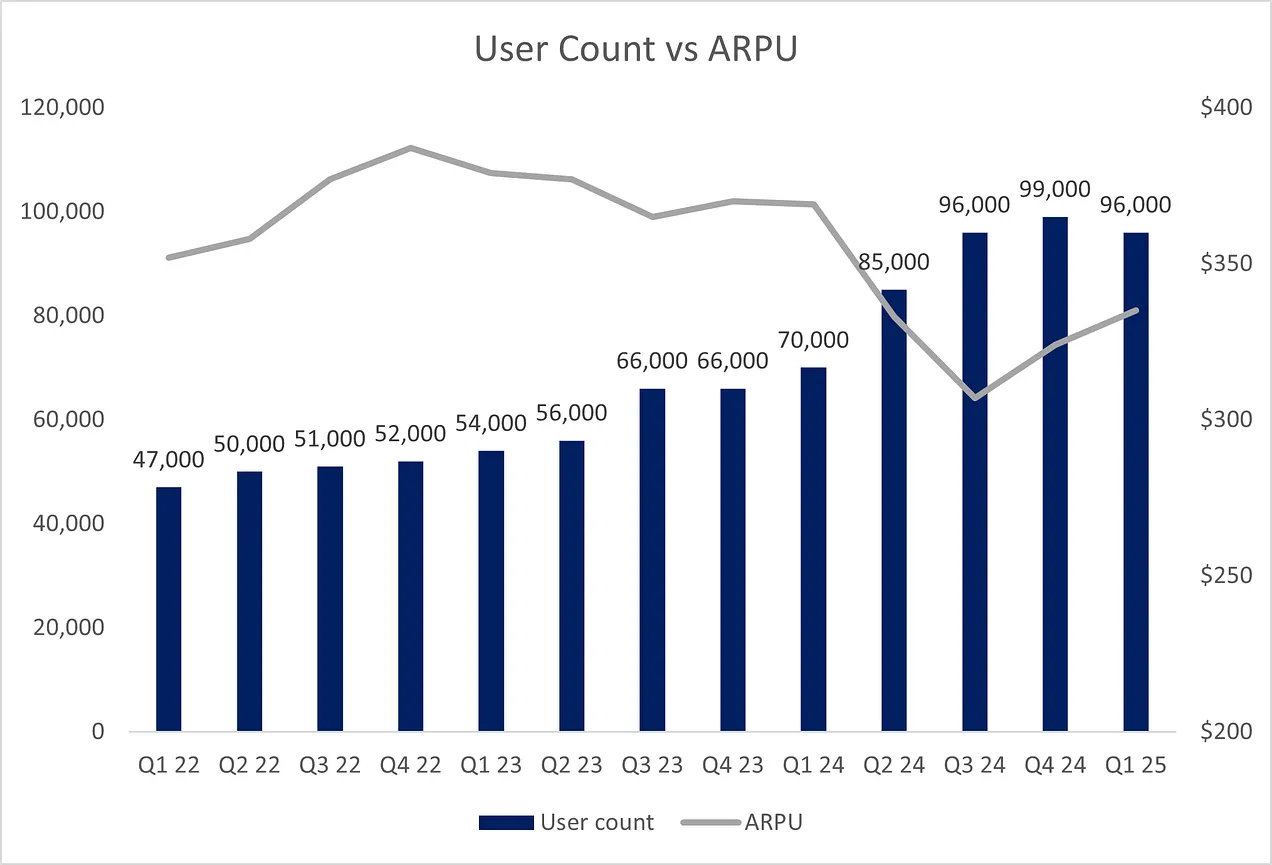

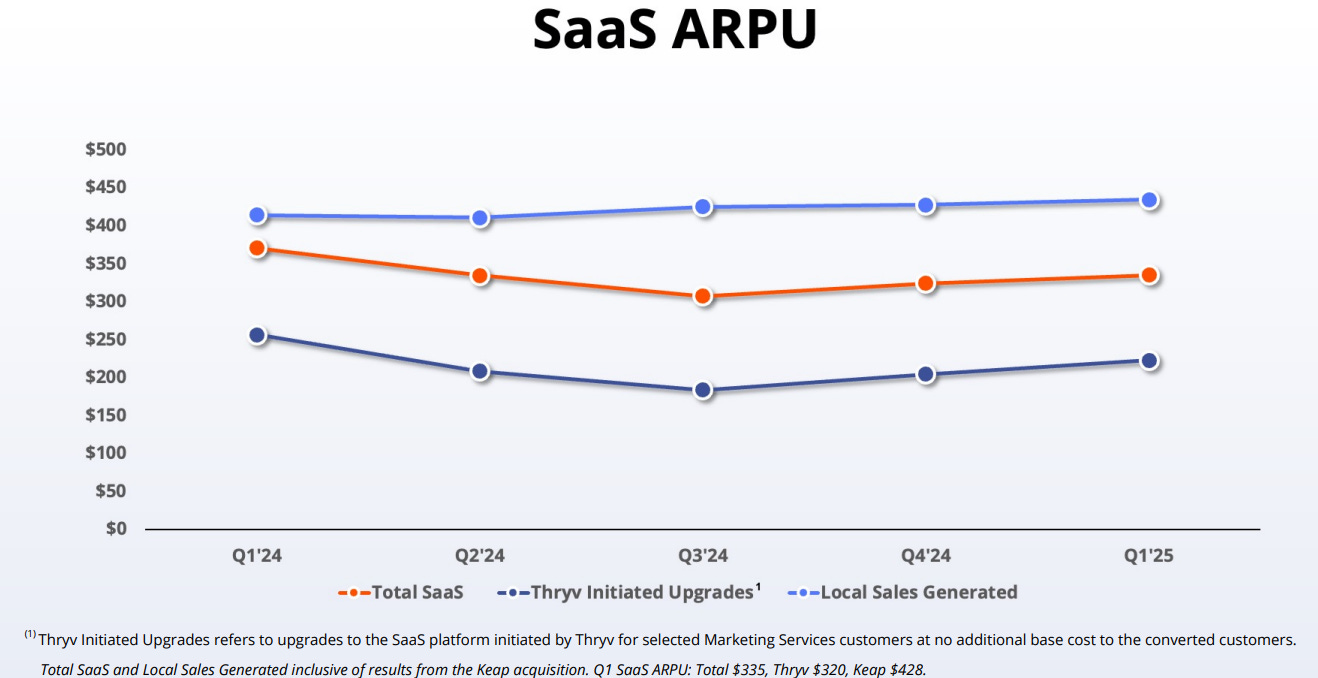

Thryv’s core strategy as of late has been to convert its legacy yellow pages customer base into SaaS subscribers. On some level, it seems to be working. By 3Q24, the company reported Rule of 40 performance. While it dipped back into the 30s in 1Q25, this is likely temporary due to cost allocations around yellow pages print timing. Multi-product usage is growing. As of 1Q25, 16,000 subscribers (~16-17% of the total) were using multiple products, up 33% year-over-year (roughly in-line with overall subscriber growth). This is a key metric to track as multicenter customers churn reportedly at roughly half the rate. Monthly churn hit as high as 3% during 2020, before declining in the following years to ~1.5%. This metric is no longer reported.

Beneath the surface, though, the base remains fragile.

SaaS subscriber growth is still driven largely by internal conversions from Marketing Services. In 2024, the company migrated 46,000 customers from that segment. By year-end, about 38,000 remained (~83%). That figure declined to roughly 34,000 in the first quarter of 2025. While the total SaaS subscriber count is rising, much of that is essentially reclassified revenue rather than new customers. In fact, the Thryv subscriber count actually declined sequentially in 1Q25:

Source: Inflexio Research (link). Excludes ~15,000 Keap subs.

Also please note that if you exclude the 38,000 converted customers included in the 4Q24 count, the subscriber count would be only 61,000 (down from 66,000 in 4Q23). It was in 4Q23, according to the 10-K, that the company decided to accelerate this effort of converting Marketing Services customer to SaaS customers. This included, “converting clients with certain Marketing Services products to the Thryv Platform at no additional base cost at the time of upgrade”, hence the ARPU decline shown above accompanying the strong subscriber growth of 2024. These converted customers come in at much lower prices:

There are a couple more things I find somewhat troubling about this picture:

While churn of converted Marketing Services customers is reportedly equal to churn in the rest of the base, wouldn’t you think this figure should be lower given they are coming in at reduced cost?

Given the reduced cost offering, wouldn’t you think that most of the low hanging fruit from this strategy has already been picked (hence the shifted focus to growing spend with existing subs, as discussed on the 1Q25 call)?

In 2024, 46k customers were converted and by year-end, 38k remained. This implies 17% of the converted customers left within 1 year of being added. If you look at the same metrics on an LTM basis for 1Q25, 44k were added and 34k remained. That’s 23% churn, or almost 2% per month. Perhaps the customers that were a good fit for this were the first ones to be converted?

While it may be true that this conversion strategy was accelerated and became more aggressive in late 2023, the earlier subscriber growth numbers are difficult to read into because there has always been some level of this going on. Management has been talking about “hunting in the zoo” since shortly after going public. This was always a part of the strategy, and I believe management has been clear and upfront about that. In the September 2020 Direct Listing Investor Day, Walsh said, “And so we put this new SaaS solution in the hands of that sales force, and they went out and began to work with those small business customers. So the vast majority of our early sales really came from penetrating that existing customer base.”

This raises the key question: what happens when the internal base is exhausted?

The company is leaning more into expansion rather than customer acquisition, to help drive multicenter adoption. But that behavior is still limited to a small part of the base as of now (~16-17%). Until adoption improves, the system remains leaky. Churn is naturally high in any SMB-focused market.

At the same time, both revenue and operating cash flow have declined steadily over the last five years. The crossover — when SaaS growth outweighs the drag from Marketing Services — has been hard to time. From a distance, the charts still look like a business in decline.

So yes, they are executing the stated strategy. The numbers support that. But whether the strategy is actually creating a healthier, more durable business is an open question. Keap may help. But for now, the model still depends on a shrinking, churn-prone foundation and a complex push toward higher-value usage. That makes it difficult to assess how far along they really are.

Framing Risk/Reward

Like many transformation stories, Thryv presents a mix of compelling optionality and hard-to-pin-down risk.

It's easy to imagine some upside scenarios that get the dopamine flowing.

Thryv’s current enterprise value is ~$900m. Management expects the SaaS segment to generate ~$70m in EBITDA in 2025, with the declining Marketing Services segment contributing another ~$78m.

The company has provided the following long-term outlook:

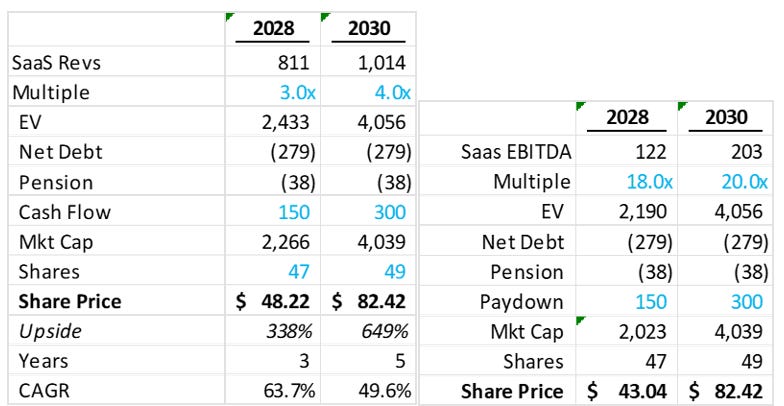

Here are some of the upside cases laid out by recent long writeups:

Source: ThatDu04 writeup on VIC

Source: Previously linked Inflexio writeup

There is nothing inherently unreasonable about these scenarios.

What gives me pause is the difficulty in estimating both the magnitude and probability of downside.

It’s not clear to me that Thryv has a moat.

Churn has been as high as 3% in the past and eventually declined to a level of 1.5%. 3% was during COVID so that is probably a little high, but let’s say normal churn is somewhere around 1.5-2% monthly, or 18-24% annualized.

Part of this is that attrition is naturally high given failure rates of small and micro-businesses. But also - I don’t believe there are significant switching costs in this business. If there were, churn would likely have never reached such high levels (business failure likely explains only a portion, perhaps 10-15%). With Seasoned NRRs historically <100% (91% in 2022, 96% in 2023, 98% in 2024) and only recently surpassing that level, there is also no strong evidence of substantial pricing power. While the trend is encouraging, it started off of a very low point and it’s not yet clear how sustainable it will prove to be.

Barriers to entry in a business like this are relatively low. So with underlying gross churn of 15-25% and no clear moat, it makes it very difficult to forecast a downside scenario. The company has modest leverage (2.2x net in 1Q25) and expects it to peak at ~2.5-2.75x in 2Q25 before declining from there. Still, it remains highly uncertain what new customer acquisition figures will look like as they move beyond converting print customers, and continue their new sales motion that is focused more on expand efforts.

While even 100% downside (which I view as unlikely) seems like an acceptable risk given the potential upside here, there are just too many moving pieces to gain any kind of conviction around the probability distribution of the potential outcomes. For that reason, even if I did consider going long, I think the position size would be very constrained. It seems like other investors have mostly come to similar conclusions as there are only two 13F filers listed with a position size >5% (and even these may be distorted by cash or international holdings).

While e.g. HUBS trades at a much higher multiple, I think this is a tough comparison to make for a couple of reasons:

It’s a pure play SaaS without a melting ice cube attached, which also allows for cleaner financials vs having to look at the segment EBITDA numbers for THRY and guess how the consolidated numbers will shake out when they are more clean and there are not questions of cost allocation.

There is no quasi revenue reclassification going on

Upmarket is a much better place to be. Fewer of your customers are shutting down each. Also, it’s easier to make a case for switching costs. If you’re a 5 person plumbing company, it wouldn’t be crazy to run your business using Excel, or even pen and paper for that matter. That’s what many of Thryv’s customers are doing before getting converted. A 50 person company paying HUBS $20k a year likely doesn’t have that option.

So while the valuation gap is wide, it’s not necessarily unjustified.

Conclusion

While I have a great deal of respect for the Thryv team and will be rooting for them, this goes in the too-hard pile for me right now. Significant stock price changes and/or KPI improvements could cause me to reevaluate, but I think it’s unlikely that the ambiguous probability picture I described above will change anytime soon so as to make this actionable.

Appendix: Misc. Notes and Ramblings

Sosin: Contained vs Uncontained Businesses

In his recent interview on Invest Like The Best, Cliff Sosin outlines a useful mental model: the distinction between contained and uncontained businesses.

A contained business is one where the key drivers are relatively narrow and stable—once you understand the immediate mechanics, external noise becomes less relevant. These are businesses where it’s easier to make durable, long-term predictions. By contrast, an uncontained business operates in a space where external forces (e.g., technological shifts, regulatory changes, shifting consumer behavior) can quickly and materially impact the company's trajectory, making reliable forecasts much harder.

Applying this lens to Thryv: it straddles both sides of the spectrum. The Marketing Services segment is quite contained. It’s a melting ice cube, yes—but one that melts slowly and predictably. You know the economics. You know the customer. There aren’t many surprises.

The SaaS business, however, is more uncontained. It sells into a volatile SMB market, where customer failure rates are high, churn is elevated, and product adoption patterns are inconsistent. The space is highly competitive with low switching costs, and it’s not yet clear that Thryv has carved out a durable moat. While the strategy is clear—convert legacy customers, deepen usage, move upmarket—there are many moving pieces that make it difficult to confidently underwrite future economics.

This uncontained nature is a big part of why, for now, Thryv sits in my too-hard pile.

CPAY: A Useful Contrast

It’s worth contrasting Thryv’s situation with something like CPAY (Corpay, formerly Fleetcor), specifically their fuel card business. That’s also exposed to the SMB market, so it deals with naturally high churn. But CPAY benefits from a real network effect—as more fuel stations and businesses join, the platform becomes more valuable to everyone. That dynamic makes CPAY the default choice for a lot of customers. There are maybe one or two viable alternatives, but it’s effectively a constrained set.

Thryv doesn’t have that. When you're churning through 1.5–2% of your base each month, you need a strong reason for the next customer to choose you. A network effect is a strong reason. A better product—maybe. But that advantage can be fleeting, and it doesn’t build the same defensive wall. Even if churn is lower than it used to be (I wish they still reported it), the underlying fragility doesn’t go away—it just stretches out over a longer timeline.

There’s probably a subset of customers that’s more durable. But it’s tough to know how large that group is, which makes it hard to model true downside for the SaaS business. As for Marketing Services, that does feel more forecastable—though I’m not 100% sure they’ll hit the long-term cash flow guide there either.

Valuation & False Precision

You may have noticed my valuation approach here is unconventional - I've essentially copied some bull cases from other write-ups and thrown up my hands on the downside. This is deliberate.

The investment industry loves to create elaborate models with multiple scenarios and sensitivity tables. But with Thryv, the key variables are genuinely unknowable: churn rates that have ranged from 1.5% to 3% monthly, customer acquisition costs in a post-conversion world we haven't seen yet, and competitive dynamics in a low-moat business.

When reasonable assumptions produce wildly different outcomes, building a detailed model becomes an exercise in false precision. You're not thinking about reality more clearly; you're just creating the illusion of analysis. When you genuinely can't handicap whether your base case has a 10% or 60% probability, spending hours tweaking assumptions in Excel isn't insight - it's just busy work.

Maybe if I had better data - gross adds broken down by new customers versus conversions, cohort-level retention curves, true unit economics by acquisition channel - it would be more knowable. But even then, with the Keap integration, shifting go-to-market strategy, and fundamental questions about competitive positioning, there are just too many moving pieces.

I'd invest more time in detailed modeling if the situation appeared both more asymmetric and more knowable. But when you can tell upfront that the exercise will likely lead to false precision rather than genuine understanding, why bother? The biggest valuation mistakes don't come from being off by 10% on your terminal multiple - they come from false confidence in fundamentally uncertain situations.

One final thought on process: I've learned that building detailed models too early can be counterproductive. The hours invested create commitment bias - suddenly you're defending an idea because you modeled it, not because it's compelling. And you’re defending your assumptions because, well, you had to put something in there. My rule is simple: if the opportunity isn't obvious from napkin math, modeling won't make it clearer. This might sound lazy, but I think it's the opposite. Time is the scarcest resource in investing. Being disciplined about when to go deep versus when to move on isn't just about efficiency - it's about maintaining the objectivity to recognize when something genuinely belongs in the too-hard pile.

Links

March 2022 VIC https://valueinvestorsclub.com/idea/THRYV_HOLDINGS_INC/1442009788

Feb 2023 VIC https://valueinvestorsclub.com/idea/THRYV_HOLDINGS_INC/3918869192

April 2025 VIC https://valueinvestorsclub.com/idea/THRYV_HOLDINGS_INC/8902562830

Inflexio Research inflexioresearch.com

Action items if researching further

Speak with any other investors who have looked at it

Especially interested in

Paulson

Samjo

Follow up with partners from Partnerkon

Speak to more Thryv customers

Speak to formers who now work at other players in the market

Other potentially interesting formers

Product review data

The board seems pretty strong. Some notable members:

Lou Orfanos. SVP/GM at Toast. Previously GM/VP of Product at HUBS 2018-2022.

Bentley University alum - go Falcons, anyone?

John Slater. Lead Independent Director since 2021. CIO of Hum Capital. Previously on the Thryv board 2013-2015. From 2009-2019, was a partner at Paulson.

Lauren Vaccarello. Marketing at Box, Talend, Salesloft, and WEKA.

Heather Zynczak. CMO of AlphaSense.

Strangely, she does not have a director bio in the proxy report.

“… at the time of our direct listing in October 2020, Amer Akhtar, Jason Mudrick [no longer on the board], Ryan O’Hara, Lauren Vaccarello and Heather Zynczak were nominated for election to the board of directors by Mudrick Capital, Bonnie Kintzer was nominated by GoldenTree and John Slater was nominated by Paulson.”

Stock ownership by the board is mostly negligible (<$1m each and mostly options) except for Walsh.

“In October 2024, the Company received a subpoena from the Division of Enforcement of the SEC requesting documents and information related to the Company’s previously publicly announced strategic conversion of its clients from its digital Marketing Services solutions platform to its SaaS solutions platform. The Company is cooperating fully. The SEC noted that the investigation is a fact-finding inquiry and does not mean that it has concluded that anyone has violated the law.”

Neighborly (a parent company of various home services franchises, including Grounds Guys) offers procurement discounts on Thryv to their franchisees.

Disclosure: this is not investment advice. I may own positions in securities mentioned.

Great write-up. The upside here is tempting and they do seem to be getting things right. But I certainly agree with your core premise that there are too many unknowable / unpredictable parts to have a high level of certainty.

A few follow-up thoughts:

1. I think the product is at least somewhat sticky. From what I've seen there are no comprehensive alternatives at this price point (sure there are single point solutions but part of their selling point is the breadth of the offering) and I think the problems Thryv is solving quickly become a core part of a small business operation. Churn can happen for a range of reasons not just bankruptcy. Could be from affordability or a less thorough initial product test before purchase relative to larger companies, with customers opting to use the product to determine if it works for them.

2. You can calculate gross churn using net dollar retention and the Thryv revenue. ChatGPT can help with a formula here. Seems to have averaged about 2.5% over the last five quarters if I've done this correctly.

3. Although churn may be higher for the SMBs, what really matters is the LTV / CAC. As you say they're hunting more in the zoo, but that doesn't mean that they're completely ignoring the outside world. Although the SMB customers churn more, there are also many more of them. And presumably it's easier to sign one up than a 50 person business? I have their average customer term at 3.25 years using a 2.5% gross churn which at the $335 ARPU puts a customer LTV at about $9k. Now I'm not quite sure exactly what the incremental spend is to get that customer since there are probably a lot of fixed costs in the sales & marketing spend line which may even include marketing services as you state. But I've seen estimates for typical SMB SaaS CAC of $1k - $5k so at the midpoint of $3k you have your 3:1 LTV / CAC ratio that is often targeted. All of this is just guess-work with little precision, but what I'm saying is that a business can be viable at this churn level.

4. I get comfort from their multiple product lines that they have available to sell. Not only will this reduce churn, as you've mentioned, but it will grow ARPU. And the incremental cost of selling a new product to an existing customer has got to be less, right? These products have also only just become available so are just starting to gain traction (alongside Keap's cross-sell). If ARPU grows close to what they have targeted in their long-term goals, you really don't need amazing customer growth to get a good outcome. My point here is that it gives them another way to win by a) reducing churn, b) increasing ARPU, and c) getting customers in with another product that may fit them better.

Keen to hear your thoughts on the above? Also interested in feedback from any further research you may do on Thryv, so please do share.