September 2024 - Investing Brain Dump

PRKS, CG, Semis, EXPE, HBI, LKQ, etc.

If you’re interested in talking more about any of the below topics, feel free to drop a comment, DM me on Twitter (@stockthoughts81), or email me (stockthoughts81@gmail.com).

PRKS seems really interesting. There is a good VIC writeup and a good one from Voss Capital.

They own SeaWorld, Busch Gardens, etc.

It is basically controlled by Hill Path Capital, a PE firm that has made great operational improvements over the course of the past ~5 years or so. A recently amended shareholder agreement essentially limits their voting power to 25% and would require any Hill Path acquisition to be supported by a majority of non Hill Path shareholders.

Recently launched a $500m buyback, which is huge on a ~$2.85b market cap and an even smaller float given how much Hill Path owns.

I don’t think the market is giving them any credit for international expansion or hotel developments which, as far as hotel developments go, seem relatively low risk.

Carlyle still seems interesting. After the 1Q report, it seemed like the market was disappointed with the $5b in fundraising vis a vis KKR’s performance and a 2024 target of $40b. Well in 2Q, they raised $12.4b. While this was still well short of KKR’s $32b (roughly flat with $31b in the two prior quarters), it seems to provide good support for the $40b target. Still, the market didn’t like 2Q and I am not totally sure why.

Fairlight Capital has one of the best 5 year track records I have seen. And I haven’t heard them talked about all that much. Only 7,762 followers on Twitter. They have compounded at 44% net since March 2019. Here’s the 2Q letter.

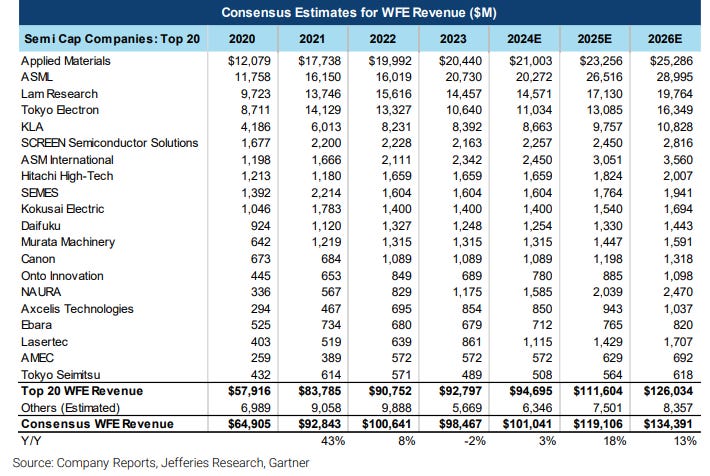

Bottoms-up consensus estimates for WFE companies reflect some big years in 2025 and 2026:

TER: “We are pretty bullish on 2025.”

MKSI continues to execute well. Not exactly sure how to think through how much upside remains. This part of the semi-cycle can get tricky…

EXPE remains interesting, in my opinion. Here is Evercore’s Mark Mahaney on why he has it as his #2 large cap internet long (as of May - PT down to $175 from $190 since then). While the macro got worse in July, it was nice to see that Vrbo had returned to growth by the end of 2Q24.

A cure for writer’s block

CCOI’s Dave Schaeffer on the LUMN deals: “I think what was announced the other day by this competitor was an acceptance of terms that we found uneconomic… My goal is not to borrow money at 7% to get a 3% return.”

Karpathy on how to learn and become an expert (link)

Gary Friedman bought $10m RH in the open market at $216 back in June

More than the cumulative amount of stock he has bought previously

It’s really tough to analyze Dollar General right now. It seems like the key issue is whether or not they can get comps back to a level where they get some operating leverage (2.5-3%?). But there are so many different moving pieces. Temu, Walmart, non-consumables mix shift, possible brand impairment, dependence on snack sales, weak < $35k household, etc.

Anyone going to the LKQ investor day next week in Nashville? Stock looks interesting. A key question seems to be - is ADAS really just a 100bps headwind?

Harshita at Bernstein finally upgraded PYPL

Some insider buying at SNBR.

HBI looks interesting.

Alpha Theory seems like a cool tool for positions sizing.

Disclosure: This is not investment advice and I/we may own positions in securities mentioned.