Regis Corporation: A Hairy Turnaround Story

Executive Summary: Is The Coast Finally Clear?

The core conflict: This is a classic deep-value situation, resurrected by a crucial debt restructuring in June 2024. The central question is whether this deal marks the beginning of a sustainable operational turnaround, or just another couple years of survival for a business in terminal decline.

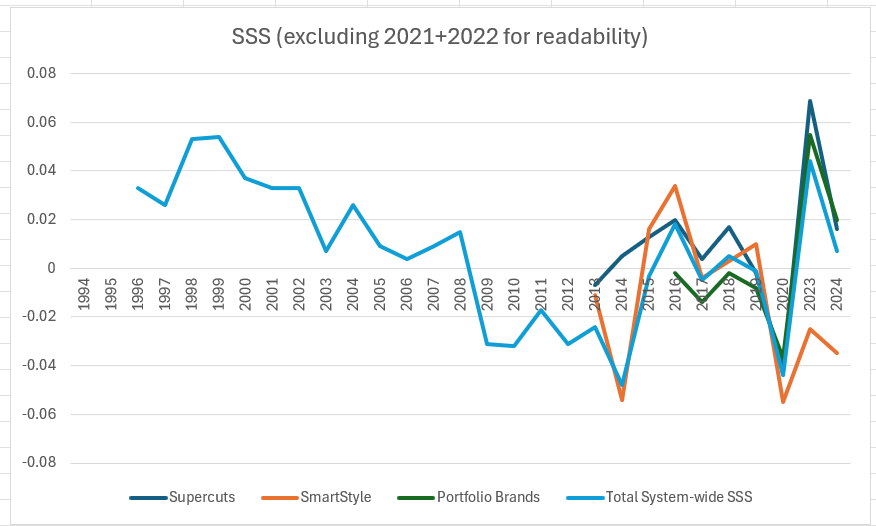

Company snapshot: Regis is a leader in the haircare industry, primarily operating as a franchisor of well-known value salon concepts such as Supercuts. Over the course of the past 15 years or so, location count has declined from ~12,000 to ~4,000. SSS have been consistently negative since the Great Recession, up until very recently.

Recent events:

June 2024 refinancing: An existential crisis was averted when Regis renegotiated its debt, receiving an ~$80 million principal reduction while extending maturity from August 2025 to June 2029. This event reset the capital structure (gross LTM leverage went from 7.9x to 4.4x) and put the stock back on the screen for value investors. The stock went from $5 to $20 on the news.

December 2024 Alline acquisition: In a strategic pivot (or return), Regis acquired its largest franchisee, reintroducing a significant company-owned portfolio. They paid $22m (~3x EBITDA including $1.5m synergies).

June 2025 leadership transition: The CEO who orchestrated the turnaround suddenly stepped down, introducing significant uncertainty about future strategy and leadership.

On paper, the investment case appears straightforward: a post-restructuring company trading at a low multiple of potential cash flow. However, this simple valuation story is clouded by a decade-long struggle with declining sales, a fiercely competitive market, and an abrupt leadership change. All this is made more concerning by a lack of recent insider share purchases. Substantial execution risk is therefore the central theme. The bull case requires new leadership to successfully engineer a turnaround that has eluded the company for years.

Background: A Decade of Decline Followed By A Glimmer of Hope

Going back and reading all the VIC writeups on RGS starting with the first one in 2010 and finishing with the Messages on the latest is an interesting experience. It has been written up seven times (six long, one short).

For our purposes, let’s go back to 2011, when Starboard (an activist with a 4-5% stake) wrote a letter detailing the current situation. Here are some of the facts from that letter:

RGS trading for 4.6x consensus 2012 EBITDA

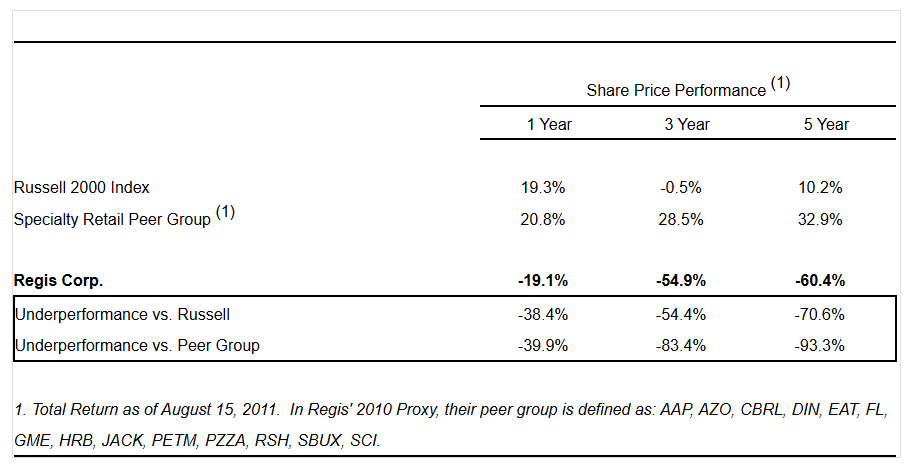

Significant share price underperformance:

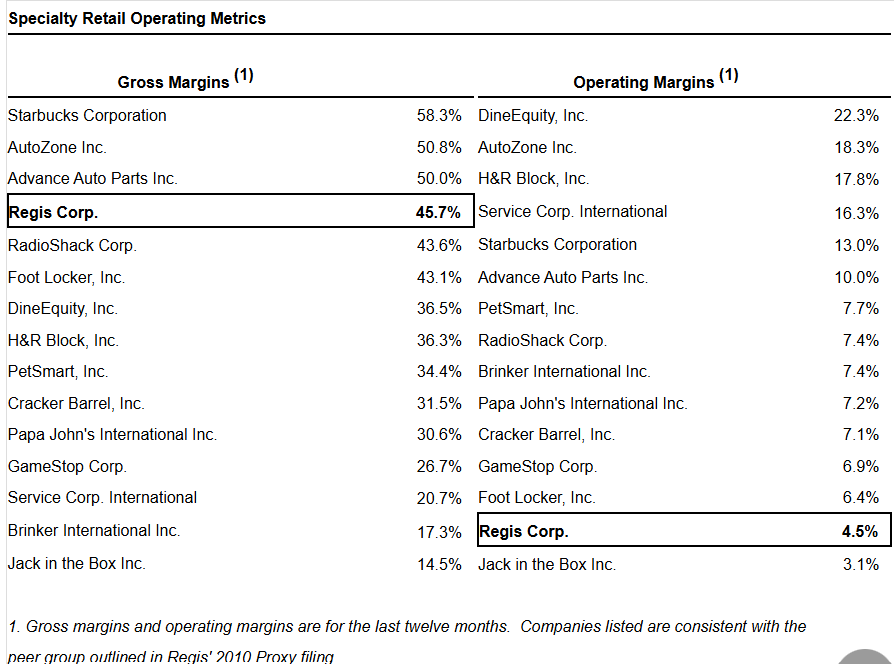

Bloated cost structure:

“[Overhead] costs have grown over 70% since 2004, while revenue has only increased 20% over the same period.” EBIT margins declined from 9.4% in 2004 to 4.5% in 2011 (LTM).

RGS owned several noncore assets. Mainly “two wholly-owned business units, Hair Club and 400 International salons, as well as two minority owned assets, Provalliance and Empire Education Group.”

Now, where are we today? And what was the path to getting here?

SSS haven’t shown any sort of sustainable return to positive territory (though perhaps we are turning a corner now with comps ~flat-slightly positive in the June quarter).

As mentioned, total store count declined from ~12,000 to ~4,000

The company embarked on an intentional shift to franchising starting in FY17. In FY16, 27% of total locations were franchised. That figure rose to 99.6% by FY24, though it is now back down to 92.4% due to the Alline deal.

The stock is down ~93% since 2011

EBITDA declined from $158m in FY11 (a 7% margin) to $25m in FY24 (a 12% margin).

Regis has seen five different CEOs since 2011 (excluding Interims), with the fifth just announcing his decision to step down a few weeks ago.

So, things were looking bleak last June with the market cap at ~$12m. And then Matthew Doctor, the CEO, pulled off the refinancing and the stock was given another life.

Then, a few months later, management decides to use their newfound flexibility to purchase their largest franchisee. Kind of unexpected! 314 salons were added to the Company-owned salon count. While the company considered it a new lever for growth and a testbed for initiatives, it also reverses that stated asset-light strategy while introducing further operational complexity.

And in the midst of all this, the CEO announced on June 23 that he would be stepping down on June 30.

The Bull Case: It’s “Cheap”

… and maybe there is a clear path to much higher FCF in the near future. Actual LTM FCF is $11.3m, having recently inflected materially higher “driven by Alline operating profitably, lower use of working capital and lower cash interest.”

Let’s build this up another way:

Let’s say baseline EBITDA is $32m. I could see this coming in a bit lower next FY if a lot goes wrong, or perhaps as high as the mid 30s if a lot goes right. But let’s use $32m. Note - this also includes some noncash items (franchise fees, amortized broker fees, etc.) - but this is meant to be a ballpark illustration.

Less $20m interest (~$15m of which is actually cash due to the PIK, but let’s use $20m)

Less $1m for maintenance capex (perhaps this could be a bit higher now that they bought Alline, but in the March 2025 quarter it was $300k).

Note cash taxes will not be a factor anytime soon as they have ~$490m of NOLs

This gets us $11m in FCF.

Some other things that could get you an even higher number

Assuming they refinance the debt sometime in the next couple years, while putting FCF toward the principal in the interim, could significantly reduce interest expense. Perhaps by as much as $5-10m between deleveraging and refinancing.

Other operational improvements such as those outlined in this investor writeup. And just executing well on Alline. I do not have a good sense for how achievable these are. My intuition suggests there is probably some low-hanging fruit if you get a great operator in here, but I cannot speak to the feasibility of the specific savings sources mentioned in the writeup, nor the probability that Alline synergies are achieved.

So, it certainly isn’t impossible to see a scenario where we are sitting at a sustainable $20m+ within a couple/few years. On a current market cap of $47m, that’s ~2.5x FCF. However, it’s important to remember how much leverage there is here. On an EV/FCF basis, this is ~7.25x FCF. Still on the low side, but not quite as attractive when you consider the long history of operational issues, stubborn negative growth patterns, and the long list of execution risks required to get to that $20m FCF (and prove to the market that it is sustainable).

Complementing the bullish view is a couple of strong datapoints from recent quarters:

For the first nine months of FY25, cash from operations was up $14.1m year-over-year.

6/23/25 PR: “The company reports positive preliminary quarter-to-date same-store sales growth of 3.0% for Supercuts and 1.3% on a consolidated basis for the first two months of the fourth quarter of fiscal 2025 as compared with the same periods last year [note there is some Easter benefit here]. Month-to-date same-store-sales through June 15, 2025 for Supercuts and Regis Consolidated are also positive as compared with the same period last year. Quarter-to-date operating expenses have remained consistent with the third quarter of fiscal 2025.”

Bulls attribute this stabilization to specific management initiatives that are gaining traction, such as the nationwide rollout of the Supercuts Rewards loyalty program and new brand excellence standards designed to improve the customer experience.

Finally, the Regis system is arguably healthier today than it has been in years. The painful, multi-year process of closing thousands of underperforming salons is largely complete. This portfolio rationalization has left Regis with a smaller but stronger and more profitable base of locations, providing a more stable foundation from which to build future growth.

The Other Side of the Coin: Risks and a Final Word

Despite the green shoots, the bear case for Regis remains substantial and is rooted in a long, challenging history. A decade-plus of negative same-store sales and failed turnaround attempts has created deep-seated skepticism. While recent SSS data is encouraging, these modest gains are fragile and have yet to prove they can reverse a secular trend in a fiercely competitive industry where rivals like Great Clips have thrived during Regis’s decline. It’s interesting to note that Great Clips is now at ~4,400 locations vs 3,000 in 2011, while Regis’ store count has declined dramatically during this time. Regis has also lost their spot on the Entrepreneur Franchise 500 list, while Great Clips has ascended to #33.

The execution risk is amplified by the abrupt departure of the CEO who orchestrated the refinancing. This creates a leadership vacuum at a critical juncture, raising questions about strategic continuity and the company’s ability to attract top-tier talent. Furthermore, the Alline acquisition, while presented as a catalyst, can also be viewed as a strategic gamble. It reverses the company’s stated asset-light strategy, reintroduces operational complexity, and requires management to prove it can run stores more effectively than the experienced franchisees it just bought out.

Financially, the argument is not a slam dunk. A ~5x EV/EBITDA multiple may be a fair price, not a cheap one, for a business with this profile. There is a long history of operational missteps, stagnant growth, and poor FCF conversion. The new debt, while manageable, is expensive at SOFR + 9.00% and will consume a large portion of cash flow until a potential (but not guaranteed) refinancing can occur.

The bull path sees a new leader successfully build upon the new foundation, optimize the Alline portfolio, and secure a favorable refinancing, unlocking the company's free cash flow potential and leading to a substantial rerating. The bear path sees the company revert to its historical pattern of decline, hampered by operational challenges and leadership turnover, with the high-interest debt continuing to weigh on the equity.

The outcome is almost entirely dependent on execution. While the valuation offers a potential margin of safety, the significant operational and leadership risks make this a classic "too hard pile" for many investors (hence the stock languishing around the level it has been at since the refinancing). There are simply too many moving parts and unanswered questions to have high conviction in either direction.

Appendix and Misc. Notes

I’d like to better understand whether longs think working capital will be less of a use of cash than it has in the past, and why. This is an important area to deep dive with both management and other investors to better understand the likely future conversion of EBITDA into FCF vs historical rates.

Be careful to exclude lease liabilities in debt calculation, which are ~90% the franchisees’ (and hit the income statement anyway). They are also all operating leases.

Don’t forget warrants from the refi in valuation

Other potential contacts and resources

William Charters - part of a now-disbanded activist group that used to own ~8-9%. Articles available on Seeking Alpha.

Gary Wyetzner. Part of the above referenced group. Insights available on X and LinkedIn.

Galloway Capital - activist.

Jeff Moore - investor, active on Twitter

EagleFangCapital on Twitter seems to follow it

Maverick_Investr on Twitter seems to follow it

Industry expert and former exec https://www.linkedin.com/in/eabakken/

Industry expert from the group that sold Alline https://www.linkedin.com/in/michael-sarafa-418052120/

Michael Reinstein (Regent LP) purchased a large group of salons back in 2017

Kent Lake Capital

Disclosure: this is not investment advice, I may own positions in securities mentioned