Writeup #2: Expedia 1Q25 Thesis Update: Navigating Headwinds, Doubling Down on B2B & AI

Steady Progress in B2B Initiatives Keeps the Thesis on Track Despite B2C Softness

For ongoing analysis of Expedia and other investment ideas, as well as updates about what I am working on/thinking about:

TLDR

Expedia's first quarter of 2025 saw revenue come in slightly below consensus estimates while EPS beat. This mixed financial picture reflects softness in the US consumer segment, while the B2B and Advertising divisions continued their strong growth.

Management, led by CEO Ariane Gorin, remains focused on several key initiatives: strengthening the B2B business, integrating AI across the platform, making selective brand enhancements, and improving the company’s technology stack to drive efficiency. Despite ongoing headwinds in the B2C segment and macroeconomic uncertainty, B2B momentum and developments such as new airline partnerships highlight areas of resilience. Valuation remains compelling.

1Q25 Performance & Updated Outlook: A Tale of Two Segments

Key Data

1Q 2025 Actuals:

Revenue: +3% (1pt Easter, 3pt FX headwinds)

B2C: -2%

B2B: +14%

Ads: +20%

Bookings: +4% (1pt FX, 1pt leap year, macro headwinds)

AEBITDA: +16% (105bps margin expansion)

Room nights up 6%

US LSD, Europe MSD, RoW Mid-teens (APAC +30%).

B2B +20%. Expedia Brand +7%. Hotels.com negative. Vrbo modest growth.

Updated Guidance:

2Q 2025: Gross Bookings +2-4%; Revenue +3-5%; Adj. EBITDA Margin +75-100 bps.

Full Year 2025 (Revised): Gross Bookings +2-4%; Revenue +2-4% (both lowered, FX noted as a 1-pt headwind to revenue); Adj. EBITDA Margin expansion raised to +75-100 bps (from +50 bps).

The first quarter's figures underscore a significant divergence within Expedia's operations.

The consumer-facing B2C segment encountered headwinds, particularly in the U.S., leading to a revenue dip and pushing Hotels.com back into negative territory. This marks a challenging shift after some positive signals throughout 2024. Softer U.S. demand, including a notable decline in inbound travel from key markets like Canada (down nearly 30%), drove these results.

In stark contrast, the B2B division continued its trajectory, acting as the primary growth engine given its strong international exposure (60%+ of bookings). Alongside a healthy 20% revenue uplift in Advertising, this provided a crucial counterweight to the domestic B2C softness.

Reflecting these dynamics, updated full-year guidance pairs a more cautious top-line (2-4% growth for bookings and revenue) with a stronger AEBITDA margin expansion target of 75-100 bps. This signals management's clear pivot to maximizing profitability and efficiency, controlling what they can amidst demand uncertainty.

Gorin's Playbook: Strategic Initiatives & Course Corrections

Restructuring & Efficiency

Under CEO Ariane Gorin, Expedia Group has continued to refine its organizational structure with a focus on simplification, efficiency, and better use of technology. In early 2025, the company restructured its product, technology, and finance teams, resulting in a workforce reduction of approximately 3%. These changes followed an earlier restructuring of the marketing team in March, which primarily impacted content creation roles globally. Looking at the broader picture since the previous year, Expedia has restructured approximately 4% of its employee base and reduced its contractor population by about 7%.

The stated goals behind these moves include simplifying the organization, improving overall effectiveness, speeding up efforts, and better prioritizing work. There's also an emphasis on making better use of AI to streamline operations across technology, commercial, and marketing teams. Management anticipates these actions will yield an EBITDA benefit of approximately $75 million over the next three quarters.

This "surgical approach" to restructuring under Gorin stands in contrast to the massive reorganization undertaken by former CEO Peter Kern starting in 2020. That earlier effort saw a much larger workforce reduction of around 30% and the closure of numerous offices, among other significant changes.

Partnership Wins & “Most Complete Shop for Airlines”

Expedia continues its efforts to expand its flight offerings, aligning with its aim to be the "most complete shop for airlines". Securing deals with major carriers is a key part of this, and two significant partnerships recently came to fruition. First, in February 2025, Expedia became the first OTA to list Southwest Airlines' inventory. According to Expedia, the "early results have been great and exceeded both our and Southwest's expectations," with one-third of travelers booking Southwest tickets on Expedia being new customers to Expedia. This influx of new demand also creates opportunities for hotel partners, as these new Southwest bookings can be bundled with package rates and deals using Expedia's existing platform capabilities.

Shortly thereafter, Ryanair's flight inventories went live on Expedia Group platforms in the US and across Europe around April 2025. This deal, stemming from a partnership announced in mid-2024, significantly adds to the travel options available by incorporating Ryanair's extensive network. Expedia reported "strong traction so far" with the Ryanair integration and noted that about 75% of travelers booking Ryanair through them are new customers to Expedia.

These partnerships are clearly a big move to get more flight options and new customers. But it makes you wonder, why now for these deals? I'd love to do a call with someone at one of these airlines to get their take on what drove the timing from their end.

AI Risks and Opportunities

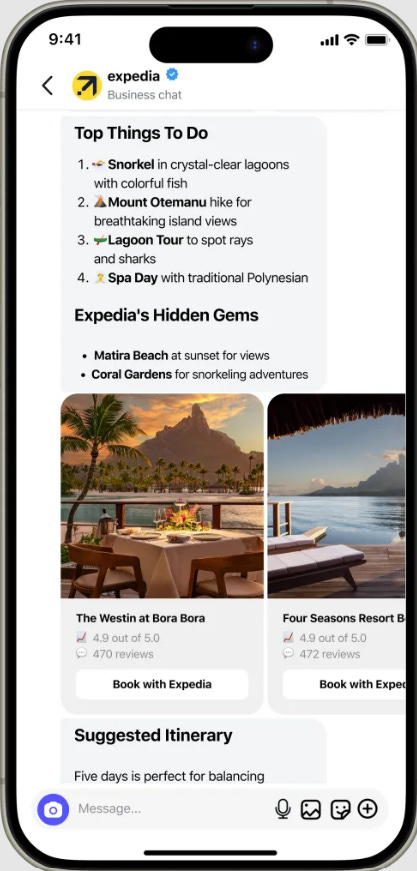

Expedia is actively exploring numerous AI initiatives, with several new features announced at their recent EXPLORE™ conference. One such product, now in beta, is "Expedia Trip Matching" for Instagram Reels. The concept allows users to DM a travel-related Reel to Expedia and receive customized itinerary ideas. Frankly, this particular feature seems a bit underwhelming at first glance (just like the first time I tried using their AI group chat assistant, Romie). The value add is minimal:

Beyond novel product features, Expedia is also partnering with major AI players like OpenAI/Microsoft, becoming a launch partner for Microsoft's Copilot Actions and integrating with OpenAI's Operator. These partnerships are strategically important as they help temper the risk of disintermediation by ensuring Expedia's brands are present wherever travel planning begins. However, the question of whether consumers will widely adopt AI agents for complex travel booking remains open. It's still very early days to predict how these new modes of interacting will ultimately play out.

The broader discussion around AI agents and their potential to disrupt OTAs has been ongoing for some time now. Concerns have been raised about AI disintermediating OTAs by booking directly with suppliers. However, there are counterarguments: OTAs provide significant value through aggregated supply, managing supplier relationships, and customer support. While an AI might eventually offer a user interface for travel, the underlying supply and service infrastructure of OTAs remain crucial.

From a financial perspective, if a significant portion of traffic shifts to AI agents acting as referrers, there could be take-rate implications for OTAs. For example, if an AI partner receives a cut of the OTA's commission, it could compress margins. However, this might also be viewed as a shift in customer acquisition costs, potentially replacing expensive search engine marketing spend. The net impact on P*Q is still uncertain; while price or take rates (P) might be pressured, it's unlikely that AI agents alone will significantly increase the overall quantity (Q) of travel. These are medium to long-term considerations, and the immediate impact on consumer behavior seems limited.

On a more concrete and perhaps immediately impactful note, Expedia is also leveraging GenAI for internal efficiencies. One interesting anecdote mentioned was the use of GenAI to coach sales teams, reportedly increasing their win rates. This type of practical application, improving existing processes, might be where the most tangible near-term benefits of AI are realized (not to mention helping to enable the previously discussed restructuring actions).

Brand Revitalization Efforts

A significant part of what Gorin needs to execute on involves getting Expedia's major consumer brands back on a stronger footing, particularly Hotels.com and Vrbo, both of which have seen strategic adjustments.

Hotels.com has faced its share of struggles, having been "heavily impacted" by a tech migration and loyalty program changes a couple of years ago. In 1Q 2025, the brand "slipped back into negative territory due to softer U.S. demand and foreign exchange headwinds". Despite this, Gorin expressed optimism about the plan in place. In late April, Hotels.com launched a new visual identity and mascot, alongside new product capabilities like hotel price insights and alerts. Crucially, Gorin also previously paused the global rollout of the unified OneKey loyalty program beyond the U.S. and U.K., recognizing that the previous, distinct loyalty program was a "big differentiator for Hotels.com" and that removing it "diluted the value proposition". The brand's stronger performance in Nordic markets, where OneKey has not been implemented, indicates the value of maintaining the original loyalty program structure.

Vrbo room nights grew modestly for the third consecutive quarter and bookings grew in-line with the market in the US. The brand has been focused on refining its offering and value proposition. Efforts to improve its appeal for shorter stays appear to be "paying off", with nearly a third of its growth in 1Q coming from the multi-unit inventory added last year. Vrbo also recently launched a new promotions suite, enabling hosts to create tailored discounts for different traveler segments to boost visibility and bookings. Regarding the OneKey program, last month Expedia "removed the always-on-earn for our blue tier [lowest tier] loyalty members on Vrbo," as the company found this particular investment "didn't drive sufficient repeat to justify the cost".

These brand-specific enhancements are built upon Expedia's long-evolving technology platform. After years of complex integration work, stemming from numerous historical acquisitions and more recent consolidation efforts, the underlying infrastructure now appears to provide a more unified and stable base. The current focus is on leveraging this foundation to develop and roll out distinct capabilities tailored to each brand's unique value proposition (such as the aforementioned pricing tools for Vrbo).

My Evolving Thesis

Looking at Expedia post-1Q, the persistent thought is that the stock still seems inexpensive. This quarter’s results didn’t change that view, but it’s worth incorporating the latest details into the broader picture.

Clearly, the B2C business is facing some pressure given the exposure to the weak US market. I would note that Expedia is not alone in this dynamic. Booking Holdings saw room nights in the US grow LSD as well during the quarter. They noted the following on their call,

“… we saw a moderation in trends for inbound travel into the U.S., particularly from bookers in Canada and, to a lesser extent, from bookers in Europe… While we saw a year-over-year increase in length of stay on a global basis, we saw a decrease in length of stay in the U.S., which could indicate that U.S. consumers are becoming more careful with their spending. We also saw some evidence of a bifurcated economy in the U.S. as higher star rating hotels appear to be more resilient than lower star rating hotels. We have not seen either of these dynamics in Europe.”

ABNB had similar comments about what they are seeing in the US:

LSD growth in nights/experiences booked in the US, which has been the slowest grower for the “last several quarters”.

Same bifurcation that BKNG mentioned

Contraction of the booking window, with some consumers “waiting and seeing” before booking summer travel

“…it's less popular to come to the U.S. from a year ago, also relative to the beginning of the year… Canadians are traveling at a much lower rate to the U.S.”

Given these comments and the strength of the B2B business, I do not believe Expedia has experienced any material deterioration in their competitive positioning this quarter.

As they weather the storm in the US, they are focusing on what they can control through ongoing restructuring efforts that should bolster the bottom line, new partnership wins, and investments in the areas of the business that warrant it.

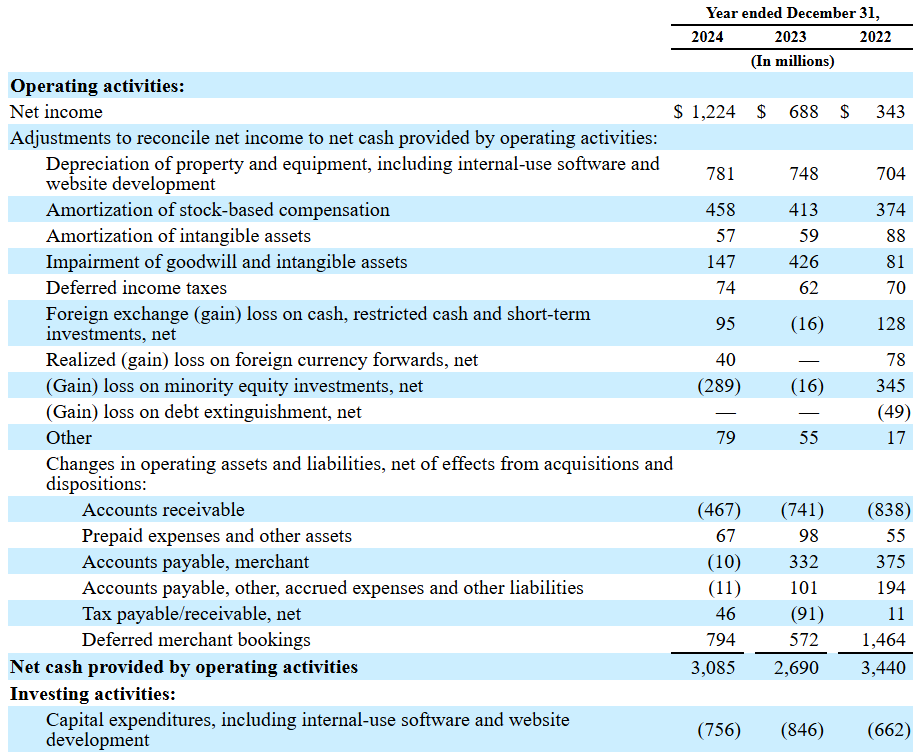

Repurchases actually ticked up this quarter, which was an encouraging sign. I am not sure how much to read into it yet, but there was an interesting comment on the call about this. Management said buybacks “should be roughly in line with levels we've repurchased over the last couple of years”. Since early 2023, the company had been consistently repurchasing ~$450-650m of stock per quarter. This declined to $198m in 4Q, which gave me some pause. But it bounced back to $384m in 1Q25. If they maintain that rate, at current prices, that would imply them repurchasing ~7% of the company annually (note these are SoCF figures and likely include some purchases to satisfy tax withholding obligations for SBC; actual repurchases in 1Q were cited on the call as $330m). They also reinitiated their dividend after suspending it during COVID.

One piece of the picture that I am still putting together is - what is going on behind the scenes in terms of the leadership dynamics? There have been several changes at the company over the course of the last couple of years.

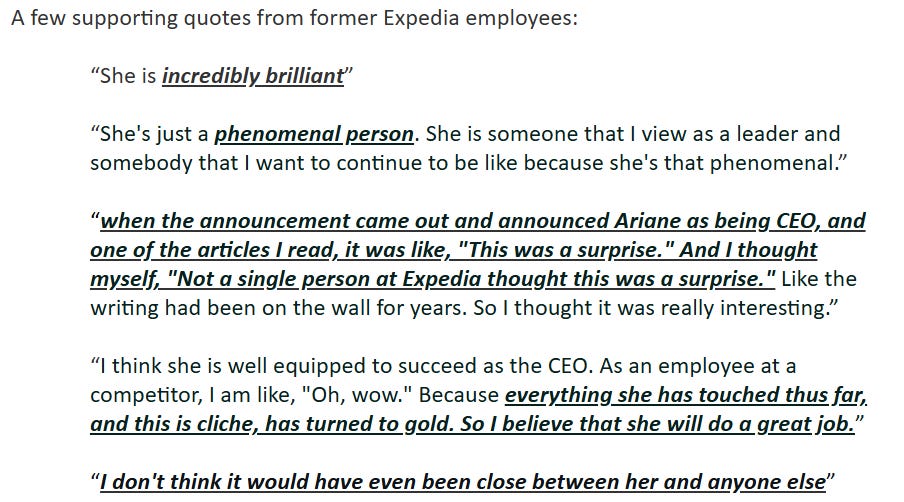

First, just to be clear, I am very pleased with Ariane Gorin as CEO and I think she was the right person for this role. So far, her execution has been solid, and this VIC article presents some expert call excerpts that suggested this would be the case:

However, besides this, there have been several other changes at the company, and I will present some of the more notable ones in a list below. Some of these make me… somewhat curious, somewhat cautious:

This Skift article highlights some of the oddities around former CEO Peter Kern’s departure from the board and his vice chairman position.

The 8-K said he “agreed” to step down “given the speed and success of the Company’s recent management transition”.

When Sam Altman departed from the board in June 2023, the 8-K noted there was not “any disagreement with the Company, its management, or the Board.” This is standard language for a board resignation, and the announcement about Kern featured no such thing.

He is not being replaced with a new board member

Last May, it was reported that Expedia’s CTO as well as a technical SVP had been fired due to a “violation of company policy”. The two had previously worked together at Verizon.

It came as a surprise to me when I read in the 3Q24 earnings release (11/7/24) that “Expedia Group and Julie Whalen have agreed that she will step down [as CFO]… effective upon the appointment of her successor, which is expected to occur before February 17, 2025. Ms. Whalen has agreed to remain with the Company through February 17, 2025 to facilitate a smooth transition. Ms. Whalen has also resigned as a member of the Board of Directors of the Company, effective today.” Then, a month and a half later on December 19th, Expedia announced that Scott Schenkel (former CFO of eBay) would be the new CFO, “effective the day after Expedia Group files its Annual Report on Form 10-K for the year ended December 31, 2024 (which is expected to be on or about February 7, 2025). As previously announced, Julie Whalen will remain in the CFO role through February to ensure a smooth transition.” Given these stated timelines, I was very surprised to see that Scott was on the 4Q24 earnings call on February 6th, and that Julie was not on the call at all. It would have been more understandable if Scott was there to answer “what attracted you to the opportunity?” type questions while Julie takes the prepared remarks and most of the Q&A, but that was not the case. It was as if Scott had already been in the weeds for some time.

On May 19, 2025, Eric Hart was appointed as Chief Strategy, Business, and Corporate Development Officer. Eric had been at Expedia from 2009-2022, and served as CFO Dec 2019 - Oct 2022. He has served as CFO of Plaid since Oct 2023. In the press release, Ariane gave a nice quote about having worked with him previously.

All in all, while there is much to monitor, I continue to believe that Expedia is heading in the right direction.

This directional confidence is supported by a valuation that continues to appear reasonable. Back-of-the-envelope FCF yield seems to be ~HSD+ (one could argue about adjustments around e.g. working capital capital, SBC, restructuring, etc.) on the $21b market cap:

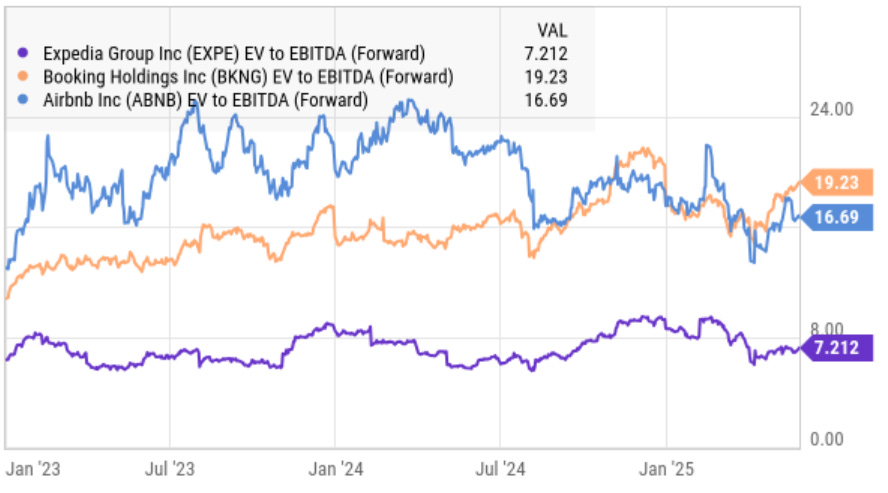

And the valuation is not even in the same ballpark as peers:

While this discount has been persistent, it seems likely that the Expedia of the next ten years will look different than the Expedia of the past ten years given all the changes made over the past several years.

The travel industry has historically demonstrated mid-single-digit growth. In a 'normal' economic environment, it’s reasonable to expect a refined Expedia to grow at least in line with the industry, with potential for modest margin expansion. Depending on how capital is deployed (and thus where the stock goes in the meantime), this paints a picture of LDD IRR, with further potential upside also possible from a closing of the multiple gap and the margin differential.

Over time, the significant margin differential between Expedia and Booking Holdings will likely become a more central part of the investment debate. That's an area I'm paying closer attention to and looking to discuss further with industry experts and other investors, as I don't have a fully formed view on the achievable long-term gap yet.

Risk & Uncertainty

At the end of the day, Expedia is still…. well, Expedia. This is another “this times it’s different thesis”, and it is clear that the investor fatigue on this one is palpable. Anyone who has followed the company themselves knows this, and probably has their own anecdotes to share. While I understand the need to take anonymous Hacker News postings with a grain of salt, I thought this one was telling. Whether or not all the details are accurate (e.g. he seems to omit Okerstrom’s tenure, as well as the fact that Kern had been on the board since 2005) is kind of beside the point. From everything I have heard elsewhere, this sentiment fits the picture.

While progress has been made in turning the company around, Vrbo still has a ways to go to look anything like ABNB or BKNG’s alt accommodations business. Hotels.com faces real challenges as well. But the fact that they are now on one consolidated tech platform, not bidding against each other on niche keywords, making efforts to try to cut the bloat and operate more efficiently, etc. - all that stuff does matter.

Beyond company-specific execution factors, other notable risks include:

Macroeconomic Conditions: The previously discussed softness in U.S. travel demand serves as a reminder that broader economic downturns typically reduce discretionary travel spending.

Competitive Environment: The online travel market is intensely competitive, with Booking Holdings and Airbnb representing significant, established competitors whose strategies and performance Expedia must continually address. While Bernstein has released a series of notes on newer entrants and rising competitors over the course of the past few years, none of these have struck me as problematic. The network effects enjoyed by all the major players in this industry are substantial.

Long-Term AI Impact: The evolution of AI continues to present uncertainty for the online travel industry regarding customer acquisition, commission structures, and overall market dynamics, as discussed in more detail earlier.

Appendix: Miscellaneous Thoughts And Notes

There are several VIC articles on the name. If read in chronological order, you can come to understand not only the situation, the business, and the improvements that have been made - but also the reason why there is such investor fatigue. Writeups that are several years apart read similarly, still talking about tech platform consolidation, efficiency efforts, etc.

Skift is a great industry resource

While I never had the budget to get the most out of it, Phocuswright is also a big name in the industry

The company mentioned B2B-specific hotel supply on the 1Q25 call. Curious to learn more about this.

I want to reiterate that I think there is a big expert call opportunity here. As of a few months ago, I don’t think there was anything exceptional on Tegus. But there are many execs who have departed in recent years, some of which are just starting to reach that six month displacement that is standard for being cleared by compliance departments. I think the critical areas to dig into are:

The culture, how it has changed since Gorin took over, the different factions of leadership over the course of the past few years, etc.

Margin expansion opportunities

Vrbo and Hotels.com - any incremental learnings on talent, issues faced in the past, where they stand now, etc.

This is also a good place to spend time on if you are new because part of understanding the opportunity here requires understanding just how much they have been shooting themselves in the foot. It is helpful to hear that sort of thing first hand.

Just testing the “this time it’s different” thesis and whether that feels true to them

Again, anonymous internet posts are to be taken with a grain of salt and even these posters say they are just rumors, but here is some speculation around the firings:

Notable 13F holders

Par Capital Management

WindAcre Partnership

“Houston-based WindAcre was started by Snehal Amin, who was a co-founder of London-based activist firm TCI.”

Goodnow Investment Group

ValueAct

They used to own much more (2%+ stake) but have been selling their stake down and now only own <1% of the company.

I have been unable to find any information about whether they were pushing for certain changes at the company

Glassdoor Notes

3.8/5.0 overall rating. 7,257 reviews. 76% would recommend to a friend.

Gorin approval rating - 80%.

Oft cited pros

Work/life balance - this shows up very frequently, to the degree that it might not make you feel great as an investor

Hybrid - 3 days in-office. Some cited return to office as a con, though.

Oft cited cons

Many view career growth as limited, unclear, or taking a long time

The company changes a lot over time, some organizational changes can feel fast paced and unclear, etc.

Reorgs/RIFs, leadership changes, etc.

“The company feels generally mismanaged, lots of turnover in senior and VP level leadership, plenty of red tape to deal with, and not very innovative technology. Can be an incredibly frustrating place to work sometimes. If you want to work fewer hours and get a decent salary this is a good place. But there's plenty of red tape, not a lot of upwards career mobility, and the company doesn't seem well managed.”

“Talented? Eager to Learn? Look Elsewhere” … “Pros: If you value work-life balance, this could be an ideal place for you. It may especially suit professionals in their late 40s and 50s seeking stability and a slower-paced environment with less intensive learning demands… Cons: Frequent reorganizations, lack of a clear long-term business strategy, slow-paced work environment, limited opportunities for learning and growth, and a toxic office culture where promotions are often based on favoritism rather than merit.”

Disclosure: this is not investment advice. I may own positions in securities mentioned.