Blocks, Bps, and Bermuda: Carlyle and Fortitude

This is part one in a four part series I will be publishing over the next several weeks about the insurance activities of the publicly traded alternative asset managers. Sign-up to follow along:

TL;DR

Carlyle took AIG’s legacy run-off vehicle and, using a capital-light model, helped stand up Fortitude Re - a Bermudian reinsurer that’s executed a string of sizable block and flow deals. Carlyle monetizes this relationship in four distinct ways:

A Perpetual Advisory Fee: A stable fee (approx. 10 bps) on Fortitude’s entire general account (GA) of ~$70-80b.

“Rack Rate” Fund Fees: Full management fees (e.g., 50-130+ bps) on the ~$21.7 billion of GA assets Fortitude has committed to various Carlyle funds.

Fund Management Economics: Carlyle (as the GP) earns management fees (and potential carry) on Carlyle FRL, the fund vehicle that holds the majority stake in Fortitude.

Direct Investment Income: Carlyle (the firm) earns its pro-rata share of Fortitude’s profits/dividends via its ~10% balance sheet investment (as an LP) in that same fund.

Fortitude Re: History & Background

Aug 2018 — “DSA Re” partnership announced. AIG and Carlyle agree that Carlyle will buy 19.9% of AIG’s legacy reinsurance platform (then DSA Re, formed earlier that year) and enter a strategic asset-management relationship. DSA Re and AIG, in aggregate, plan to allocate $6B into Carlyle strategies.

Nov 2018 — Rebrand + close. Deal closes; DSA Re is renamed as Fortitude Re; Carlyle’s 19.9% stake is confirmed.

Nov 2019 → Jun 2020 — Majority sale from AIG. A newly formed Carlyle-managed fund, alongside T&D Holdings, agrees to and then closes on a 76.6% acquisition of Fortitude Group Holdings for $1.8B; pro forma ownership at close: Carlyle & its fund investors 71.5% (incl. the earlier 19.9%), T&D 25%, AIG 3.5%.

Mar 31, 2022 — Growth capital + new advisory deal. Carlyle raises $2.1B for Fortitude (incl. T&D); CG will commit up to $150M. The raise expands Fortitude’s capital base and reduces CG’s direct stake (from 19.9% → ~10.5%). Simultaneously, a new strategic advisory agreement is expected to add ~$50B to fee-earning AUM and ~$50M in annualized FRE (effective Apr 1, 2022), with Carlyle expecting to more than double that FRE by 2025.

Today — Multi-line reinsurer executing block + flow. Fortitude now runs a large, diversified book (life/annuity + P&C run-off; plus flow). According to the 2024 Group FCR, Fortitude’s ultimate parent (FGP) has four principal owners with the following undiluted interests: a Carlyle-managed fund (Carlyle FRL) at 38.53%, a Sovereign Wealth Fund at 32.64%, T&D at 26.37%, and Corebridge (AIG) at 2.46%. The Sovereign Wealth Fund was a former LP in Carlyle FRL and received its direct stake via an in-kind distribution after exercising an option for direct ownership.

People

Fortitude’s DNA features both Carlyle and AIG significantly. The first CEO, James Bracken, had been at AIG for 12 years (most recently as CFO - General Insurance). Brian Schreiber (MD and Co-Head of Global Financial Services Partners at CG in 2018; currently Head of Carlyle Insurance Solutions) had spent 20 years at AIG before joining CG in 2016. There are a number of notable management team and board members at Fortitude:

Schreiber remains Chairman of the Board

Alon Neches - Current CEO of Fortitude

Sept 2022 - Present: CEO of Fortitude

2020-2022: MD and Partner at Carlyle Insurance Solutions

2011-2019: various senior positions at AIG

2009-2011: Restructuring at Federal Reserve Bank of NY; managed the Fed’s AIG investment

Jeff Burman - General Counsel of Fortitude. Previously Deputy GC - Reinsurance at AIG.

Mark Jenkins - Board member at Fortitude and Head of Global Credit at CG

Several other impressive members of board and management I did not mention (see here).

It’s worth noting there has been some turnover over the course of the past few years

Former CEO - James Bracken

Former Chief Life and Annuity Reinsurance Officer - Guillaume Briere-Giroux (only there for 11 months)

Former Chief P&C Reinsurance Officer - Jack McGregor (farewell post)

Carlyle Strategic Rationale

Carlyle’s venture into insurance with Fortitude Re is a deliberate, “capital-light” strategy designed to extend its core investment management franchise rather than transform Carlyle into a balance-sheet-heavy insurer. The primary rationale was to tap into the massive, long-duration asset pool of the insurance industry, creating a significant, scalable, and permanent source of fee-earning AUM (FEAUM) without assuming the direct leverage, volatility, and regulatory burdens of an insurance operator.

The strategy creates primarily two distinct, high-margin revenue streams for Carlyle:

A Perpetual Advisory Fee: Through a 2022 strategic advisory agreement, Carlyle earns a fee on Fortitude’s entire general account. This fee is approximately 10 basis points (totaling $74 million in 2024 on a ~$75B GA) and is structured as a perpetual contract. This provides a stable and growing base of high-margin Fee-Related Earnings (FRE), as the teams and platform to manage the assets are largely already in place. The initial 2022 agreement, for example, added $50 billion to Carlyle’s FEAUM and an initial $50 million in annualized FRE (and we know the fee rate is ~10bps).

High-Fee Fund Allocations: Fortitude allocates a significant portion of its general account, totaling ~$21.7 billion in committed capital as of mid-2025 (or ~25% of its GA), into various Carlyle funds. On this capital, Carlyle earns its full “rack rate” management fees (e.g., 50-130+ bps), which are substantially higher than the 10 bps advisory fee. To put this in perspective, this makes Fortitude Carlyle’s largest and most strategic LP. The relationship represents ~$22B in committed capital plus a ~$75B advisory mandate, a massive footprint against Carlyle’s $465B in total AUM.

This structure creates a powerful flywheel. As Fortitude grows its general account by executing large, “B2B” reinsurance deals for complex blocks (like the $28b Lincoln transaction, $3b Unum, or the $4b Taiyo Life deal), Carlyle’s 10 bps advisory fee base grows immediately, and the pool of capital available for high-fee fund allocations expands, driving a second layer of FRE.

By the Numbers: Quantifying the Fortitude Relationship

This relationship is already highly material to Carlyle. Fortitude’s audited financials show a $74 million “Strategic Advisory Services” expense paid to Carlyle in 2024. For context, Carlyle reported $1.1 billion in total Fee-Related Earnings (FRE) for 2024.

The advisory fee alone thus represents ~6.7% of Carlyle’s total FRE ($74M / $1.1B).

This percentage doesn’t even include the second, higher-margin stream: the full “rack rate” fees from Fortitude’s ~$21.7B in committed capital. When factoring in those additional fees (plus, note that management guided the Lincoln deal alone would add $40M in incremental FRE), the total Fortitude-sourced contribution is even higher.

Open Questions and What To Watch For

Advisory-fee “doubling” scorecard. In Mar-2022, Carlyle said the new Fortitude advisory would add ~$50m annualized FRE and that they expected to more than double that by 2025. Fortitude’s audited financials show Strategic Advisory Services expense to Carlyle affiliates of $74m in 2024 (vs. $52m in 2023). That expense line is the best public proxy for the gross advisory take; it grew ~1.4–1.5× vs. the ’22–’23 base, but that doesn’t translate 1:1 to FRE (though it is probably close to it). Bottom line: as of FY-2024 they hadn’t “doubled” on a clean, apples-to-apples FRE basis, and 2025 is still TBD until Fortitude/FGH and Carlyle report. Lincoln should help some and possibly get them quite close given management guided to $40m incremental FRE from the deal over time.

Could “>2×” happen without GA/NIA growth? Unlikely. The advisory bps are banded and tied to Fortitude profitability; with returns drifting down a bit over time (Fortitude’s core ROA was 1.06% in 2024, down from 1.32% in 2023), getting to “>2×” looks tough.

However, it is worth noting that in recent public commentary management has been very upbeat about the amount of activity Fortitude is seeing. It would only take a few large blocks (or another Lincoln) to get them to their target. Perhaps even just Lincoln is enough.

On the Q3 2025 earnings call, Carlyle’s CFO stated that Fortitude’s recent initiatives (including the Unum deal and the new Asia sidecar) are expected to generate “more than $20 billion of new AUM in the intermediate term”

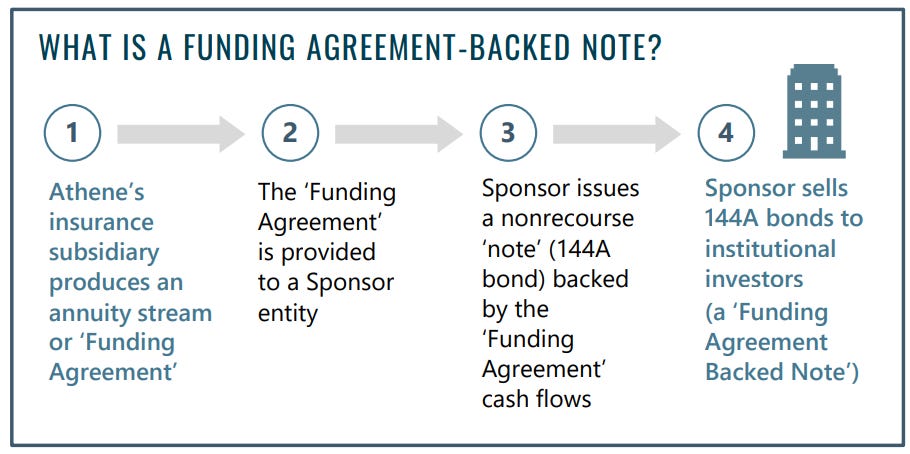

A new growth lever: FABNs. Fortitude just entered the Funding Agreement-Backed Note (FABN) market with an inaugural $500M issuance in October 2025. This is a key tool used aggressively by peers like Apollo’s Athene ($11B+ issued in 2024; almost $30b total from all funding agreements) to raise liabilities at scale from institutional investors. While this first deal is small, watch if Fortitude scales this channel; it could significantly expand its capacity to fund large reinsurance deals, further accelerating the growth of Carlyle’s advisory and fund fee base. From Athene’s 2022 Retirement Services update:

The black box problem. Like all insurance, Fortitude is somewhat opaque. While Carlyle investors get the fee stream without the direct balance sheet risk, the sustainability of that fee stream depends on Fortitude’s viability. You’re trusting management on complex asset-liability management (ALM), navigating complex regulations across different jurisdictions (e.g., Bermuda), and dealing with limited disclosure on reserving assumptions, surrender rate models, and longevity risk. While Fortitude has a deep bench of 170 actuaries, it has also seen notable departures (CEO plus both reinsurance chiefs). For Carlyle investors, the key comfort remains: they’re getting the fees without the direct leverage and blow-up risk of owning the insurer.

A new growth lever (Asia): In parallel with the FABN market, Fortitude is expanding its global footprint. In Q3 2025, it “launched a reinsurance sidecar focused on driving growth in Asia”, capitalized with over $700 million, to pursue reinsurance deals in the Japanese market (where they are already a very strong player). This creates another avenue for AUM growth outside of the competitive U.S. market.

Disclosure: None of this is investment advice, I/we may have positions in securities mentioned.