April 2024 Investing Content and Ideas

Where Baylor is leaning in, flow states in investing, and more

Where A Top Performing Endowment Is Leaning In Right Now

Earlier this year, I was surprised to learn that Baylor University has one of the top performing endowments, outperforming all the Ivy Leagues (except for Brown) over the past five years. Their strategy seeks to capitalize on dislocations in the market.

This opportunistic approach was recently detailed by Baylor’s CIO, Dave Morehead, on Capital Allocators. He describes the strategy as one that goes where the market is telling them to go (rather than setting allocation targets and sticking with them). This took them to high yield energy in 2016 when 60 was the new par, long vol in 2017/2018 when the Vix was near all-time lows, reopening trades after COVID, and small cap biotech when they were down 60% in 2022.

Where are they leaning in right now? Small caps. Due to a number of reasons (the Mag 7, talk of recession, higher rates, etc.) the spread between large caps and small caps is the highest it has ever been.

There was also a good overview of Baylor’s diligence process with a lot of interesting details:

If you’re after fame, you probably aren’t a fit.

Looking for managers with humility. If you are going to be wrong 45% of the time, you need to be able to admit you’re wrong. Or you will blow up.

Insecurity masquerades as humility. Insecurity is a big issue because it infects the organization. If the manager is insecure at their core, they are unlikely to give authority, rope, or opportunity to other people at the organization. Everything must go through them. That will cost them talent. And the manager will end up siloed. They won’t accept others’ critique of them. They will stop getting better. One obvious way to test this - how widely is equity pushed down in the organization? Because secure people will trust the people around them and encourage them. They want smarter people sitting next to them. And they reward those people by pushing equity down into the org.

Baylor starts almost all manager meetings by saying who they are. Managers say that doesn’t happen often. It’s because - the manager should understand the LP as an organization and what they are trying to accomplish. And if that doesn’t mesh, probably best to just part ways now.

Start with a deck - can tell you within 5 minutes if it’s a possible fit. Then Zoom. Then in the office. If you’re in the office, that meeting is probably between 1.5-3 hours.

Questions

Young, single guy - what’s your favorite drink when you go out with friends?

Married with kids - ask questions around vacation time and whether your spouse is aligned with you doing this. There is one manager they have in their book where it was early in the life of the firm. David had known the guy already but he was starting a new firm. Dave called his wife and spoke to her for an hour asking questions to try to assess whether the manager was able to come home and be present with his family. He wanted to make sure that she understood that if Dave funded this, it was going to be an all-consuming thing, and he wanted to know if he was going to be able to turn on the off-switch when he got home. “I don’t want to do this if this is not going to be good for your family.”

Graham Duncan also wrote about this in his “Letter to a friend who may start a new investment platform”: “A start-up requires so much time that if your spouse is resentful or not fully on board, it affects the likelihood of a venture’s success. It’s also easier to hold a lot of ambiguity if your home and basic spending needs are taken care of for a while. If they’re not, your spouse may be bearing significant risk and less available to help psychologically with the risks at the office.”

References - will often ask to talk to neighbors. Will talk to old college roommates. People who have known them for 20 years, outside the industry. They ask what the manager acted like as a junior in college. “Because my view is that people don’t really change.”

Achieving Flow As An Investment Analyst

I recently listened to David Melnikoff on the Think Fast, Talk Smart podcast. He discussed his research on the flow state. The consensus view around flow says that entering the state requires striking the right balance around boredom and challenge. This was the first time I heard something challenging that. Melnikoff says that it is more about reducing uncertainty. He gives an example of shooting free throws. In any given free throw, there are only two possible outcomes. So focusing on whether it goes in or not isn’t a very flow-inducing or captivating task. He suggests instead focusing on the length of your streak, as this carries more uncertainty.

“The source of flow is engaging in an activity that allows you to reduce uncertainty about your future, engaging in actions that reduce possible future outcomes, or ideally, eliminate all possible future outcomes except for one.”

I’m curious to hear what others think about this idea in general (I’m still not sure), as well as how you might be able to apply it to an investment analyst’s role.

At a very high level, I think it might have some applications. For me, right now, I am focused largely on turning over as many rocks as I can but also doing a thorough workup on them so that I am ready to pull the trigger if an opportunity presents itself. Whether that applies to you given your process and strategy is something you will have to answer yourself, but that’s the place I have found myself in at this time. Given that, how can I use this uncertainty concept to induce flow? One possible idea is trying to beat personal times it takes to thoroughly turn over a rock. Or within that, personal times to e.g. get through a transcript, or a valuation, or fill out a certain section of the research report. This, of course, all would need to be done while maintaining quality. You’d also need to consider other aspects like complexity and familiarity. E.g. reading a 200 page 10-K of a company in an industry you don’t know will take much longer than a 70 page 10-K of a company you have followed for a while.

I don’t know, this isn’t perfect and I am just spit balling at this point. Not sure if I love the idea or know how to apply it. Another angle with which to view it is, if you are working on something and it starts to look like it might be actionable, every incremental step you take reduces uncertainty around - is this a buy? How should it be sized? Etc.

Let’s see what Claude comes up with:

Here are a few ways an investment analyst could apply Melnikoff's uncertainty principles to get into a state of flow:

1. Focus on the investment process rather than individual stock picks. Similar to the free throw example, putting too much emphasis on whether any single stock pick is right or wrong is unlikely to induce flow, as there are only binary outcomes. Instead, focus on optimizing and mastering the overall investment process - idea generation, research, modeling, etc. Seeing continual improvement in the process carries more uncertainty and opportunity for flow.

2. Concentrate on leveling up skills and abilities… top analysts develop mastery in information gathering, analytics, and communication. Deliberately practicing and sharpening these skills, with the goal of steadily progressing from novice to expert, provides ample runway to progressively reduce uncertainty about one's future capabilities. This matches well with Melnikoff's formula.

3. Tackle open-ended research questions. Rather than just updating models or monitoring current holdings, regularly pursuing curiosity-driven research projects focused on truly understanding businesses and uncovering new insights induces productive uncertainty. Posing questions like "Who will be the long-term winners in this industry and why?" and then letting one's research gradually narrow the possibilities is conducive to flow.

4. Embrace healthy uncertainty around investment outcomes. Having too much conviction in any single position's future performance reduces uncertainty in an unproductive way. Maintaining an open-minded, probabilistic approach where multiple future paths are entertained can actually facilitate flow when researching a stock. The resolution unfolds with the research process.

In summary, analysts can apply the uncertainty principles by focusing more on mastery of skills and processes than outcomes of single decisions, proactively driving open-ended research, and maintaining a healthy degree of uncertainty around investment outcomes. Directing attention to areas with productive uncertainty to be progressively resolved enables more frequent access to flow states. The principles mesh well with developing the analyst's edge through cultivating differentiated information, analytical and communication abilities.

I don’t know, all of that seems kind of broad/obvious.

In some ways, I feel like the whole research process is about reducing uncertainty. Maybe that’s part of what makes it fun.

Other Investing Content and Ideas

Three of four stocks that seem like they might be cheap and I am trying to find people to talk to about (including any recommendations for the best sell-side analysts):

LKQ - I don’t know why it was down 14% on that report. The organic growth guide for 2024 was reduced by only 100bps to 3.5%. And they maintained adj diluted EPS and FCF guides. My best guess is that the market doesn’t believe them about the latter two given the 500bps gross margin headwind in N America, which really hurts on the bottom line given ~LDD operating margins. They say there are cost cutting actions in progress to meet those guides, but we will see. The FinishMaster integration sounds like it is going well. It’s a bit tough to decipher all the moving parts and their impact on the margin. I am not exactly sure if pre-Uni-Select LKQ is structurally higher margin vs post-deal, or if the synergies will outweigh the near-term dilution.

HUM - when I asked Twitter who the best sell-side analysts were, someone recommended BofA and Wolfe (based on the five likes on that tweet, it seems like people generally agree). I thought that was interesting because these were the two analysts that caught my eye for asking good questions on the call. I think the key point here is the margin. Because of how low it is. The top line has some element of uncertainty to it but it is really the margin that can throw things off here. If I am forecasting 4.5% and it comes in 100bps low, that’s a pretty big deal. They said on the call that over time the Individual MA business will get back to 3%+ margins and is currently breakeven. Frankly, I am not even sure what this is referring to. I don’t see in the financials where it breaks out Individual MA margins, just the Insurance segment as a whole and that was near 3% in the quarter. Are we just taking their word for it? I am not sure. The analysts’ questions centered around what this 3%+ implied for an enterprise margin. One question and answer seemed to suggest the prior $37 EPS target implied a 3-3.5% margin vs the 3%+ they are talking about now, so that seems to suggest the same kind of ballpark of EPS is achievable on a delayed timeline (and adjusting for unprofitable county exits).

EXPE - besides US concentration being unfavorable vs Europe, there is no reason this should have underperformed BKNG as much as it has historically. At its core, it is a network effect business with strong secular tailwinds of ~4-5% lodging growth plus some growth in online penetration and alternative accommodations. The issue is when you look back at the VIC writeup from 2015 it reads like the 4Q23 earnings call… “the investment is behind us… we consolidated all our tech… etc. etc.”. So maybe this is a story that continues to get kicked down the road, but all indications are that they are in a better spot with One Key, one experimentation platform, not competing against each other on Google Keywords, etc. What I am most curious to learn is about ValueAct’s take on the situation and whether there is anything they want to see done.

I’ll be surprised if MTCH doesn’t turn things around. Maybe dating apps have fallen permanently out of favor? But probably not. Underlying drivers of online dating aren’t going anywhere and neither is the network effect. But the management team doesn’t seem to do themselves any favors. The ChatGPT press release was horrendous. Max cringe.

Interesting thread on time-management strategies for public equity investors https://x.com/ChairliftCap/status/1778577484482793815

“@liensofnewyork” is looking for a new role: “Looking for a new seat and open to having conversations. Prefer NY. Happy to share coverage and more background over DM or email. liensofnewyork@gmail.com”

“@waterboycap” is looking for an internship: “I am currently looking for an internship (on-site) at a value-oriented fund in the NYC/LA area. Eager to contribute meaningfully to a team. Please don't hesitate to reach out if you know of any opportunities; it would be greatly appreciated.”

Profile on Carlyle Group (link)

KKR had their investor day and said they would grow EPS from $3.42 in 2023 to $15+ in 10 years or less. What a powerhouse! Maybe someday Carlyle will be able to do the same and have people believe them.

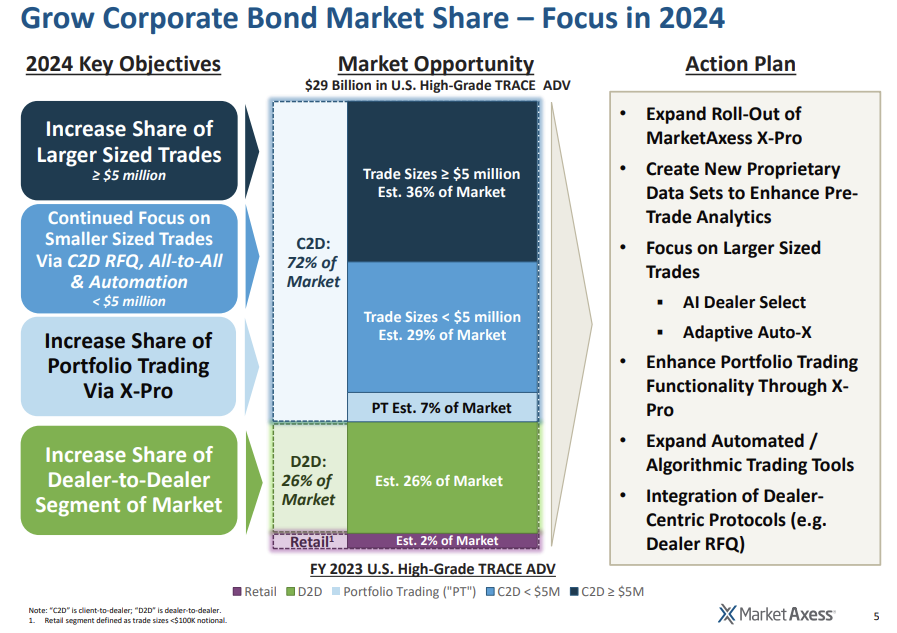

I think this was a new slide in the MKTX deck that shows how they are addressing market share issues and how the sub-markets break down. In theory, this is such a wonderful business. But it seems like they have underinvested in the product and are suffering for it now. We will see if this is enough to turn it around.

My friend launched a prediction market website for equity analysts (link)

FICO decided to talk more about how their pricing works in light of some of the recent regulatory issues (link)

Other Non-Investing Content and Ideas

Coleman Ruiz, a former Navy SEAL and current PE operating partner (COO of Lids), was recently on the Huberman Lab podcast where he talked about overcoming mental and physical challenges.

How to End Drama Around Time Agreements (link)

"STOP ALL COMPLAINING AND CONTROLLING. Once you know you’re not playing the same game, a formula for making yourself and others crazy is to keep complaining about how they’re playing the game."

Great article profiling Jhourney, a startup focusing on jhana meditation retreats.

Aim to get rejected often (link)

Major Ian Thomas: “Everything possible to my hand becomes possible to that glove–but only in the measure in which the glove is prepared simply to clothe the activity of my hand… That is what it is to have Christ, by His Spirit, dwelling within your redeemed humanity.” From “The Saving Life of Christ” by Ian Thomas.

Disclosure: This is not investment advice and we may have positions in securities mentioned.