13F Deep Dive (1Q25): A Quarterly Review of High-Signal Manager Trades

Introduction

See the appendix for the manager list as well as a list of limitations this analysis faces.

Two notes about the manager list

Please let me know if you think there is anyone who either should be added to or removed from the list, and let me know why.

Any feedback is welcome, but I am especially interested in adding concentrated small cap managers with strong long-term track records.

This list is largely a function of who I am familiar with, how I invest, some of the names I follow, etc. E.g. I may not have included some of these funds if they hadn’t been top of mind from looking at PRKS, which led to PRKS showing up more than it probably would for most people if they did this exercise with their own list.

I assembled a list of 40+ managers that I respect to varying degrees and for varying reasons. I then picked out 1Q trades from this group that were the most interesting based on a combination of factors including my respect for the manager, my interest in the company, the position size, the size of the add, and the difference between the current price and the lowest price at which these purchases could have occurred.

I am generally more focused on buys when I do this analysis. I may sometimes make note of sales, but there was nothing of interest for me this quarter.

Please let me know if you’d like a copy of the raw data for yourself.

There are a few terms to define up front:

Current vs Low = (Current price / lowest price during the quarter of the trade) - 1

Position size = Position size at quarter end / 13F Portfolio value at quarter end

Purchase size = Estimated purchase amount (dollars) during the quarter / 13F Portfolio value at quarter end

Note - When I say ValueAct purchased 1130bps of META - that refers to purchase size (and obviously not that they bought 11.3% of META)

Note that position size and purchase size are distorted by the limitations addressed in the appendix. This can result in some strange results where e.g. sometimes purchase size > position size. Nevertheless, I am working with the data I have and hopefully it still provides some level of directional signal.

I plan on doing these every quarter so let me know if there’s anything else you’d like to see, and sign-up if you want to be updated in the future:

Trades of Note

ValueAct - Purchased 1130bps of META. 13% position size. Up 26% from the lows.

I wonder what they think about the AI capex, and if there is any activist angle here. Not sure it is possible to be activist in META but I guess they can try to have some influence.

$4.5b of 13F securities vs $11b AUM listed in their ADV, so position size is materially overstated here.

WindAcre - Purchased 940bps of SGI (formerly TPX). 9% position size. Up 22% from the lows.

WindAcre was founded by a former TCI investor. I read one article that said he was a co-founder there but not sure what his role was throughout the time he was there and/or how he worked with Chris.

It appears they own 4.99% of SGI. Not sure if they just stopped to avoid a 13G.

Abrams also purchased 240bps of SGI to make it a 6% position

Browning West had no change but maintains it at a 50%+ position (not sure about non-13F holdings). This position size alone is meaningful in that I believe Browning West is likely the most knowledgeable investor in the mattress industry and TPX/SGI. Their history goes back to the founder’s activist involvement in TPX while he was at H Partners (they put Scott Thompson in place).

Select Equity still owns 7%+ but has been selling this year.

ADW purchased 780bps of TIC to make it a 7% position. Up 4% from the lows.

After close, TIC announced a cash and stock merger with NV5.

ValueAct - Purchased 692bps of V. 10% position. Up 12% from the lows.

Valley Forge, Market, and BRK did not change.

Giverny, TCI, AltaRock, TCI, and Akre trimmed small amounts while still maintaining significant positions.

Gate City added 683bps to HLX to make it a 16% position. Down 7% from the lows.

They first purchased it in 4Q24

“We are an international offshore energy services company that provides specialty services to the offshore energy industry, with a focus on well intervention, robotics and decommissioning operations.”

I believe Gate City knows the offshore/energy space well and has been investing in it for quite some time now.

Sale rumors last year (link)

Numerous VIC writeups, the most recent one is this.

Long Walk purchased 664bps of APPF to make it an 11% position. 10% above the lows.

They know this name really well.

Tim Bliss (APPF board member from IGSB/Partners Fund) has been buying as well.

Alex Wolf has been buying (another Director associated with IGSB)

Bob Casey has been buying (another, newer Director also associated with IGSB)

Bill Oberndorf, who has some looser ties to IGSB, bought a few million

Breach Inlet added 504bps to PRKS to make it a 10% position. 3% off the lows.

Voss added 177bps to make it a 7% position. Their writeup is solid.

Philosophy added 76bps to make it a 2.5% position.

Simcoe trimmed slightly, still a large position.

Hill Path (stuck at ownership limit of 50%+ and trying to work something out with the Board to approve further buybacks) just got a waiver of the Shareholder Agreement to add one more director to the Board to make it three directors for them.

ShawSpring added 483bps to BRZE to make it a 12% position. Down 14% from the lows.

Unfamiliar with this one. Some kind of marketing software. Citi note suggests ~100% upside.

Alta Fox added 478bps to IAS to make it a 4% position. Up 3% off the lows.

North Peak added 451bps of ELV to make it a 15% position. Up 4% off the lows.

Does anyone else have an aversion to this industry? Especially after following what happened to Humana. I just can’t convince myself that I understand the business enough and the potential risks.

ShawSpring added 445bps to NCNO to make it a 14% position. Down 2% from the lows.

Philosophy added 435bps to NFE to make it a 5% position. Down 72% (!!) from the lows.

Anyone know what happened here?

Greenhaven Road added 356bps to PAR to make it a 25% position. Up 8% off the lows.

Voss added 127bps to make it 8%

ADW no change, 52% position.

“More than meets the eye here. KEKE is owned by DENNY's - once a PUNCHH cust. PAR has mentioned that several PUNCHH custs. are returning and we understand $DENN is one of them. Table serv. , POS, Payment, lot to like here.” - see here.

Newtyn no change, 5% position.

Alta Fox added 347bps to ARCO to make it a 4% position. Up 8% off the lows.

Fernbridge added 339bps to CRM to make it an 11% position. Flat from the lows.

Tencore- small add. 7% position.

ValueAct - no change, 17% position.

Breach Inlet added 329bps to BUR to make it a 10% position. Down 10% from the lows.

Greenhaven Road- no change, 9% position.

Greenlea - small trim, 4% position.

Other highlighted trades

Voss has written up many of their names in their letters.

As far as I could tell, JELD was always a disaster vs DOOR. But it’s an interesting industry, and it feels like it should be a somewhat better business. Legal documents from past antitrust cases have shown that DOOR has historically had the upper hand, not sure what the thesis is for this to change.

Recent CSGP writeup on VIC, focused on activist catalyst.

Curious to hear Jacob Rubin’s pitch on MTCH, that one surprised me. I wonder if he sees anything to indicate trends are turning, or if it’s just a value play.

Stone House DBI position looks really interesting. $111m market cap. Designer Shoe Warehouse.

I may end up writing up CCOI soon.

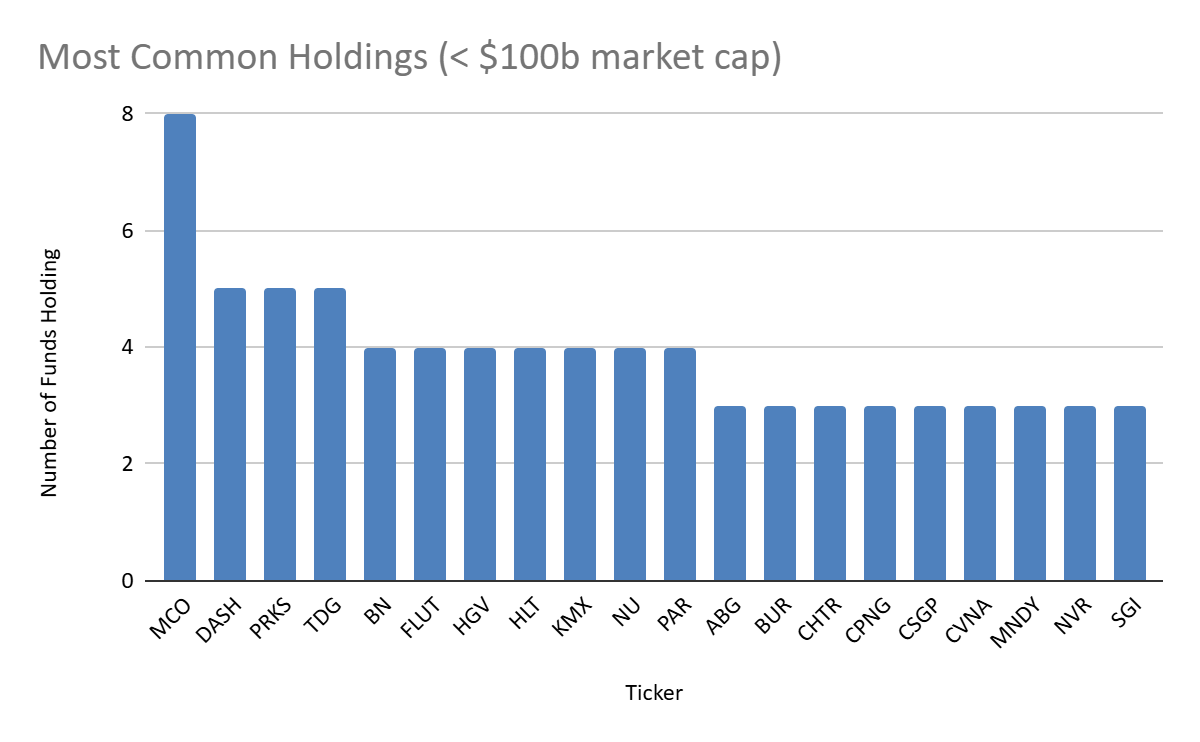

Lot of people own HGV.

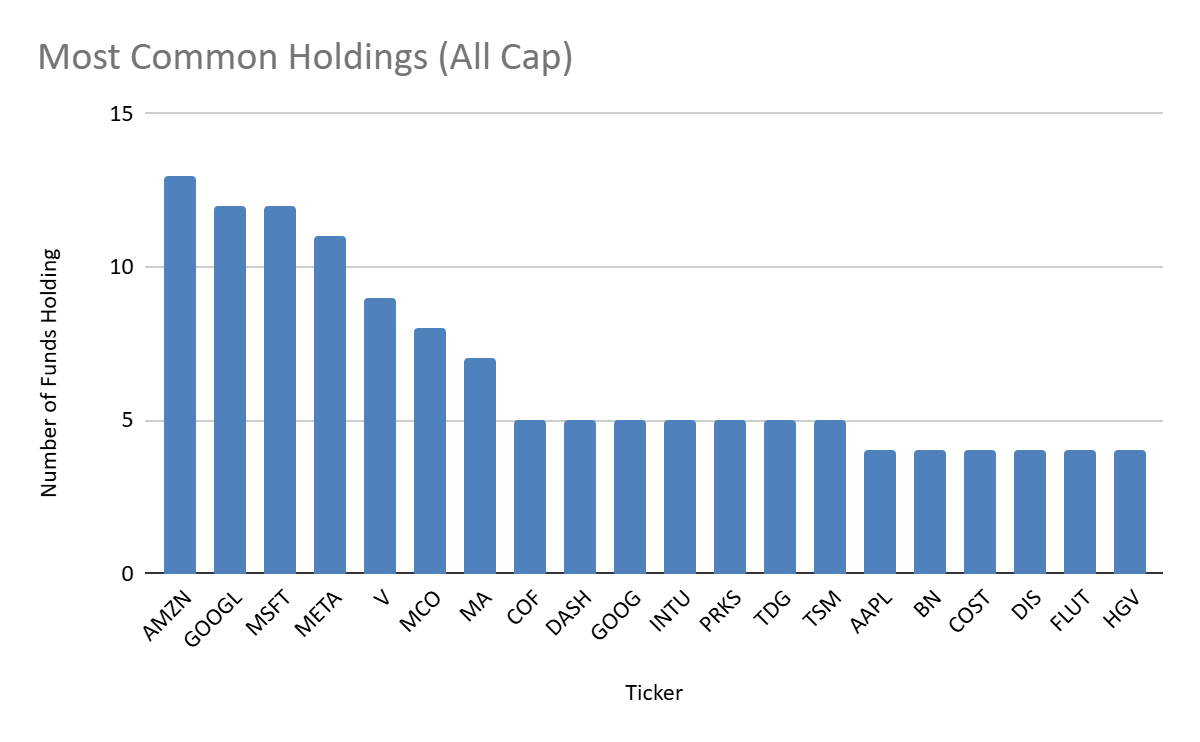

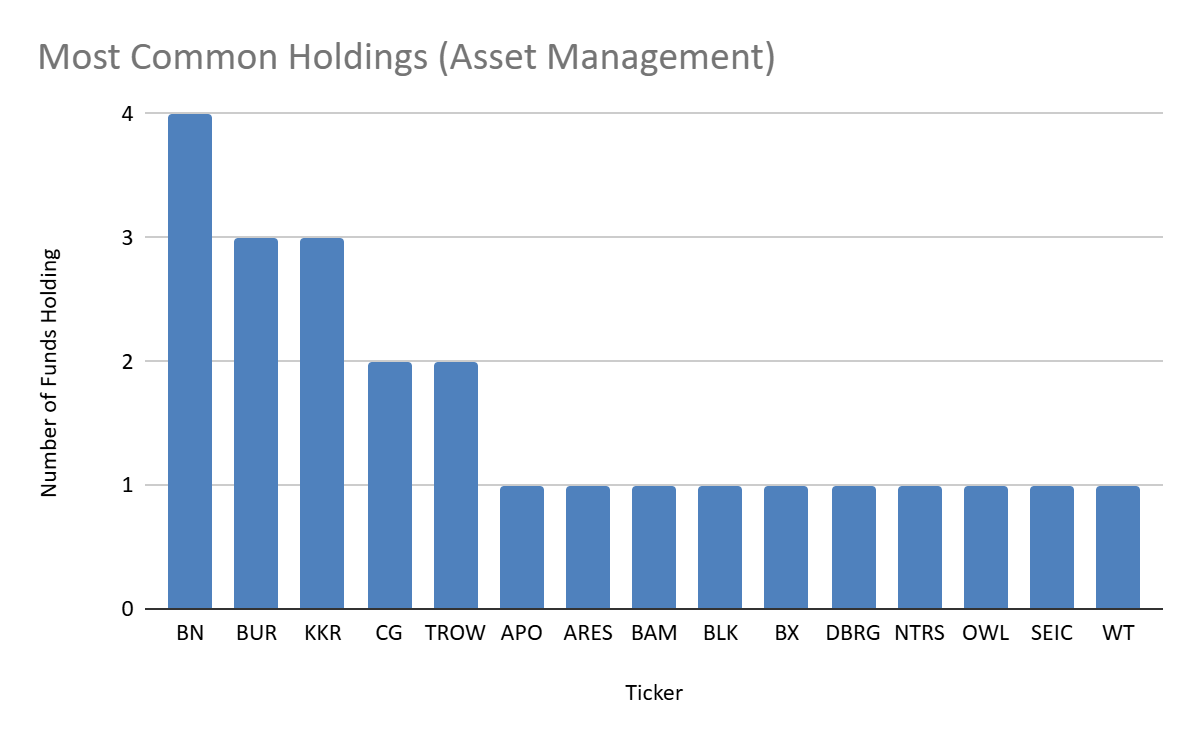

Other Analysis

Appendix

Manager List:

Abrams Capital Management L.P.

ADW Capital Management LLC

Akre Capital Management LLC

Alta Fox Capital Management LLC

AltaRock Partners LLC

Ampfield Management L.P.

Barton Investment Management

Berkshire Hathaway Inc.

Breach Inlet Capital Management LLC

Browning West LP

Caledonia (Private) Investments Pty Ltd

CAS Investment Partners LLC

Daily Journal Corp.

Dragoneer Investment Group LLC

Fernbridge Capital Management LP

Gate City Capital Management LLC

Giverny Capital Inc.

Greenhaven Road Investment Management L.P.

Greenlea Lane Capital Management LLC

Hill Path Capital LP

I.G.Y. Ltd.

Long Walk Management LP

Markel Group Inc.

Miller Value Partners LLC

Newtyn Management LLC

North Peak Capital Management LLC

OLP Capital Management Ltd.

Pershing Square Capital Management L.P.

Philosophy Capital Management LLC

Rings Capital Management LLC

RV Capital AG

Shawspring Partners LLC

Simcoe Capital Management LLC

Spruce House Partnership LLC

Stockbridge Partners LLC

Stone House Capital Management LLC

Strategy Capital LLC

TCI Fund Management Ltd.

Tencore Partners LP

Tyro Capital Management LLC

Valley Forge Capital Management LP

ValueAct Holdings L.P.

Voss Capital LP

Windacre Partnership LLC

Limitations of using 13Fs

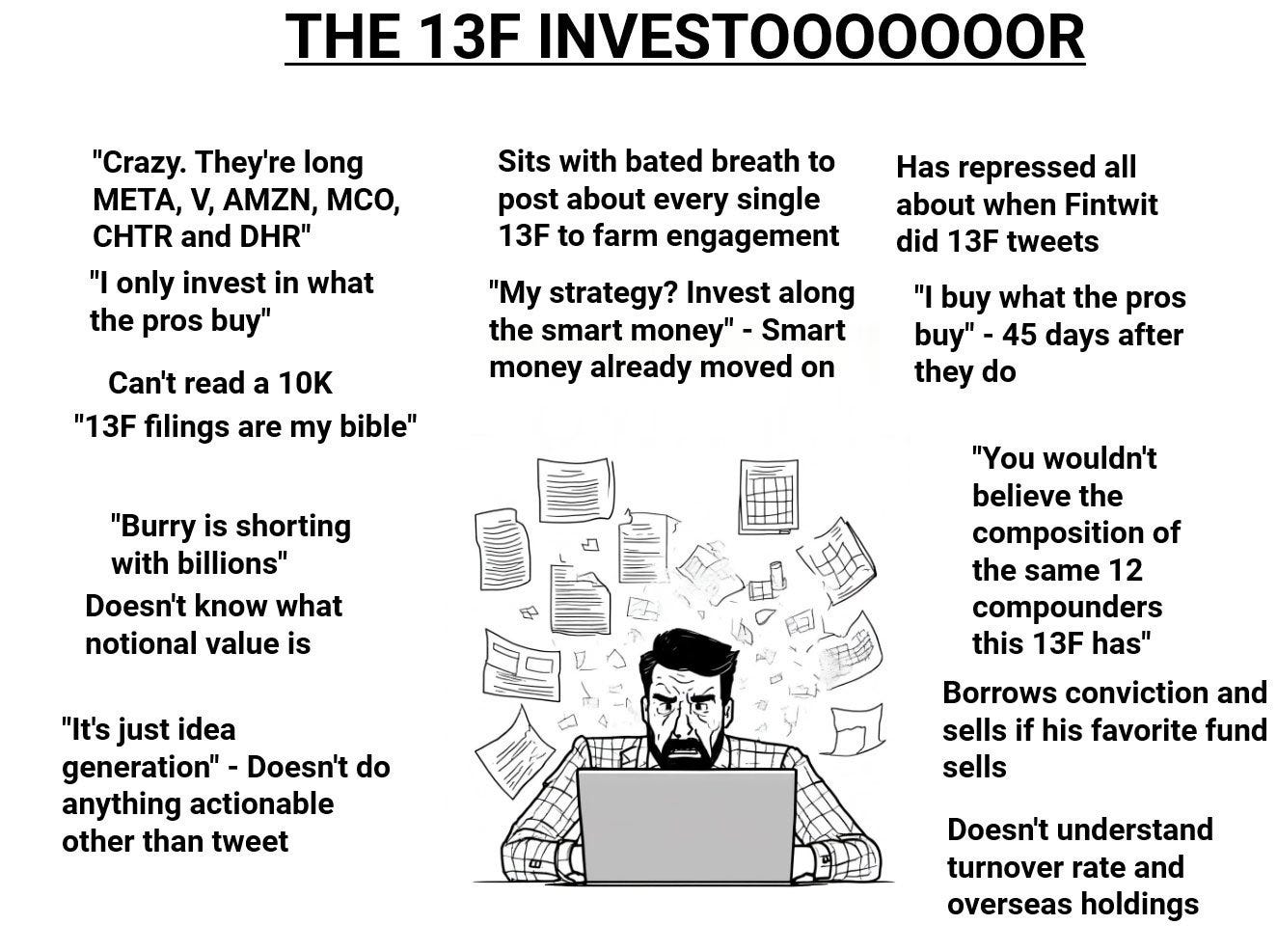

13Fs do not include non-US exchange holdings, short positions, cash, etc. The filings are delayed. Options are notional value. We don’t know what prices securities were traded at. Deciding who is actually high signal is tough for a variety of reasons. I could go on, but in short, don’t be these guys:

Source: Cluseau Investments on Twitter

Source: not sure of the original (maybe Mads Capital?) but thanks to Sell Side Pleb on Twitter for finding it

Disclosure: none of this is investment advice and I may own positions in securities mentioned

Love this

https://open.substack.com/pub/johnlawxv/p/the-best-smallcap-in-eu-is-hiding?utm_source=app-post-stats-page&r=31luz&utm_medium=ios